Capital gains tax is a crucial aspect of the financial landscape that impacts investors and taxpayers alike. Understanding this tax can help individuals make informed decisions about their investments and financial strategies.

Essentially, capital gains tax is levied on the profit earned from the sale of an asset, and knowing how it’s calculated is vital for any investor. Different rates apply depending on whether the asset was held short-term or long-term, which can significantly influence investment choices and overall returns.

Understanding the Basics of Capital Gains Tax

Capital gains tax is an essential concept in the world of investing and personal finance. It refers to the tax levied on the profit made from the sale of an asset, such as stocks, bonds, or real estate. Understanding how this tax functions is crucial for investors and homeowners alike, as it can significantly affect the overall return on investment. The IRS categorizes capital gains into two main types: short-term and long-term, each with different tax rates and implications.

Calculating capital gains tax hinges on determining the difference between the selling price of an asset and its original purchase price, known as the basis. The formula to calculate capital gains can be summarized as follows:

Capital Gains = Selling Price – Purchase Price (Basis)

To illustrate, if an investor buys shares of stock for $1,000 and later sells them for $1,500, the capital gain is calculated as follows:

Capital Gains = $1,500 (Selling Price) – $1,000 (Purchase Price) = $500

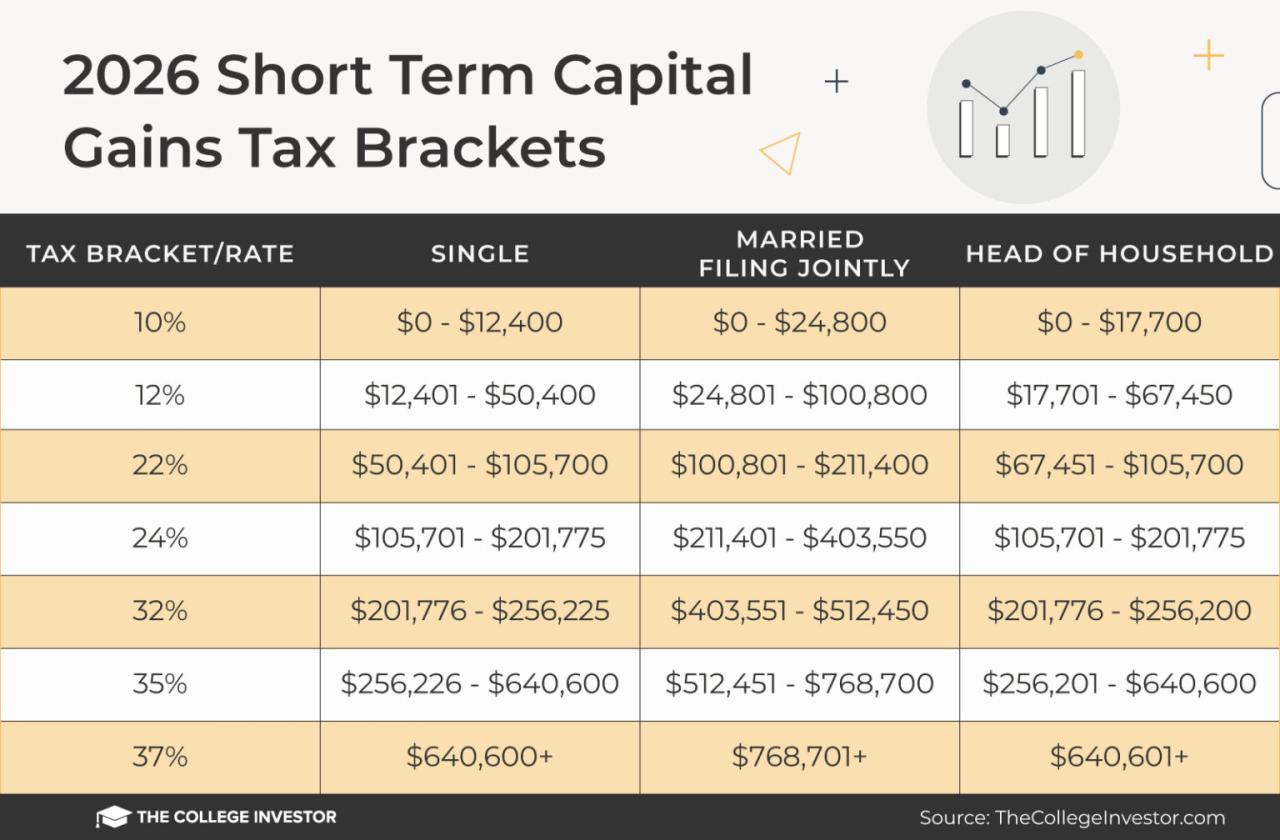

The capital gains tax rate applied to the gain can vary based on how long the asset was held before sale. Short-term capital gains apply to assets held for one year or less and are taxed at the investor’s ordinary income tax rate, which can range from 10% to 37%, depending on the individual’s income bracket. Long-term capital gains, on the other hand, are applicable to assets held for more than one year and are taxed at reduced rates, typically 0%, 15%, or 20%, depending on the taxpayer’s overall taxable income.

Short-Term versus Long-Term Capital Gains Tax Rates

The distinction between short-term and long-term capital gains is pivotal for investors. The tax implications can significantly influence investment strategies. Below is a detailed overview of the tax rates for both categories:

- Short-Term Capital Gains:

- Applicable to assets held for one year or less.

- Taxed at ordinary income tax rates.

- Long-Term Capital Gains:

- Applicable to assets held for more than one year.

- Tax rates typically are 0%, 15%, or 20%, depending on income level.

Understanding these principles is vital for effective tax planning and maximizing investment returns. By being aware of how capital gains tax operates, investors can make informed decisions about buying and selling assets.

The Impact of Capital Gains Tax on Investment Strategies

Capital gains tax significantly shapes how investors approach their investment strategies. The tax is levied on the profit made from the sale of an asset, and understanding its implications can lead to more informed financial decisions. As investors strive to maximize their returns, the awareness of capital gains tax can either encourage or deter specific investment behaviors.

Capital gains tax influences investor behavior in several ways. For instance, the tax burden can lead investors to hold onto their assets longer than they otherwise would, a strategy known as “tax deferral.” By doing so, they aim to postpone the tax liability until a more favorable tax year or to take advantage of lower rates on long-term holdings. Notably, the difference between short-term and long-term capital gains tax rates can significantly sway decisions. Short-term gains, typically taxed at ordinary income tax rates, can be as high as 37%, while long-term gains enjoy a reduced rate, often capped at 20%. This disparity encourages investors to think strategically about the timing of their asset sales.

Strategies to Minimize Capital Gains Tax Liabilities

Investors employ various strategies to minimize capital gains tax liabilities, making informed choices to optimize their tax outcomes. Understanding these strategies is essential for effective investment planning. The following approaches are commonly utilized:

- Holding Investments for the Long Term: By holding onto assets for more than a year, investors can benefit from reduced capital gains rates.

- Tax-Loss Harvesting: This strategy involves selling underperforming assets to offset gains realized on other investments, effectively reducing overall tax liability.

- Utilizing Tax-Advantaged Accounts: Investments held in accounts like IRAs and 401(k)s can grow tax-deferred or even tax-free, minimizing the impact of capital gains tax.

- Investing in Opportunity Zones: Investing in these designated areas can offer tax incentives, including deferral or potential exclusion of capital gains.

Investors must also consider the effectiveness of different investment vehicles concerning capital gains tax. Some vehicles are more tax-efficient than others. For example, exchange-traded funds (ETFs) typically generate fewer capital gains distributions compared to mutual funds due to their structure, making them a more tax-friendly option. Additionally, real estate investments may offer capital gains tax advantages through 1031 exchanges, allowing investors to defer taxes by reinvesting in similar properties.

Understanding the right balance of investment strategies and vehicles in light of capital gains tax can greatly enhance an investor’s overall financial performance. By being proactive and informed, investors can navigate the complexities of capital gains tax, turning potential liabilities into opportunities.

Capital Gains Tax Exemptions and Deductions

Capital gains tax can significantly impact your financial planning, especially when selling assets like real estate. However, there are several exemptions and deductions available that can help mitigate the tax burden. Understanding these provisions is essential for making informed decisions regarding your investments and maximizing your returns.

When navigating capital gains tax, various exemptions and deductions can minimize your taxable gains, allowing you to keep more of your profits. Here are key exemptions available under capital gains tax, particularly in real estate transactions:

Exemptions Available Under Capital Gains Tax

Several exemptions specifically apply to capital gains tax, making it crucial to identify which ones apply to your situation. The following exemptions are noteworthy:

- Primary Residence Exemption: Homeowners can exclude up to $250,000 (or $500,000 for married couples) of capital gains when selling their primary residence, provided they have lived there for at least two of the last five years.

- Like-Kind Exchange: Under IRS Section 1031, investors can defer capital gains taxes on the sale of investment properties if they reinvest the proceeds in similar properties.

- Exemption for Inherited Property: When you inherit a property, its basis is stepped up to its fair market value at the time of inheritance, which effectively eliminates capital gains tax on appreciation during the decedent’s ownership.

- Qualified Small Business Stock Exemption: Investors can exclude up to 100% of capital gains from the sale of qualified small business stocks held for more than five years.

Understanding these exemptions can lead to considerable tax savings, especially for homeowners and real estate investors.

Common Deductions Reducing Taxable Capital Gains

In addition to exemptions, there are specific deductions that can help offset capital gains and reduce overall taxable income. These deductions include:

- Cost Basis Adjustments: Improvements made to a property can increase the cost basis, thereby reducing the taxable gain when sold.

- Transaction Costs: Fees associated with selling a property, such as agent commissions, closing costs, and legal fees, can be deducted from the capital gains.

- Depreciation Recapture: For investment properties, previously claimed depreciation may be recaptured as ordinary income, which can affect the overall capital gains calculation.

By keeping detailed records of deductions, taxpayers can effectively lower their capital gains, leading to significant savings.

Examples of Exemptions in Real Estate Transactions

Specific situations exist where capital gains tax exemptions can apply to real estate transactions.

For instance, a couple sells their home for a profit of $600,000. Assuming they meet the primary residence criteria, they can exclude $500,000 of that gain, resulting in only $100,000 subject to capital gains tax.

Another example involves a property inherited by an individual from a parent. Upon selling this inherited property, they benefit from the stepped-up basis, which effectively negates any capital gains tax if the property appreciated significantly during the parent’s ownership.

Understanding these exemptions and deductions is crucial for anyone looking to navigate the complexities of capital gains tax effectively. By leveraging available benefits, taxpayers can optimize their financial outcomes when selling assets.

The Role of Capital Gains Tax in Economic Policy

The capital gains tax plays a significant role in shaping economic policy, influencing growth and inequality across various countries. Understanding its implications is crucial for policymakers, investors, and the general public alike. The capital gains tax, levied on the profit realized from the sale of non-inventory assets, can affect investment behaviors, savings rates, and overall economic health.

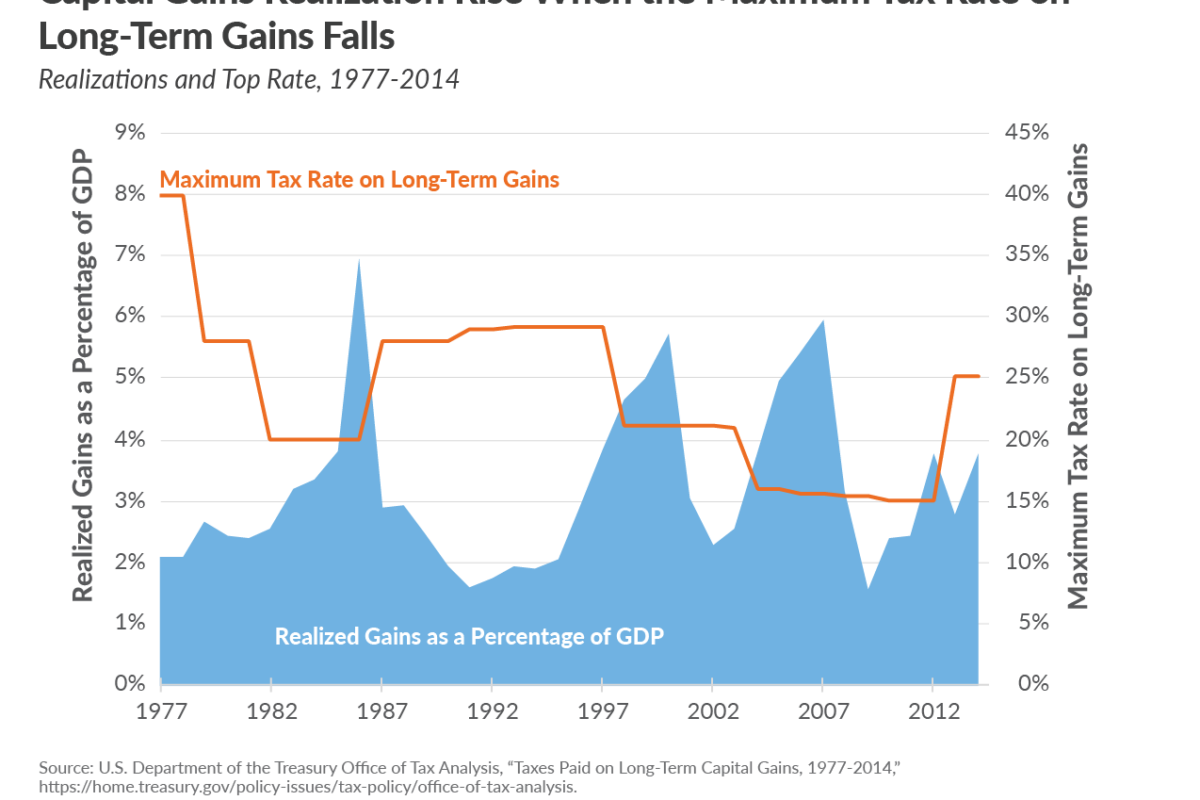

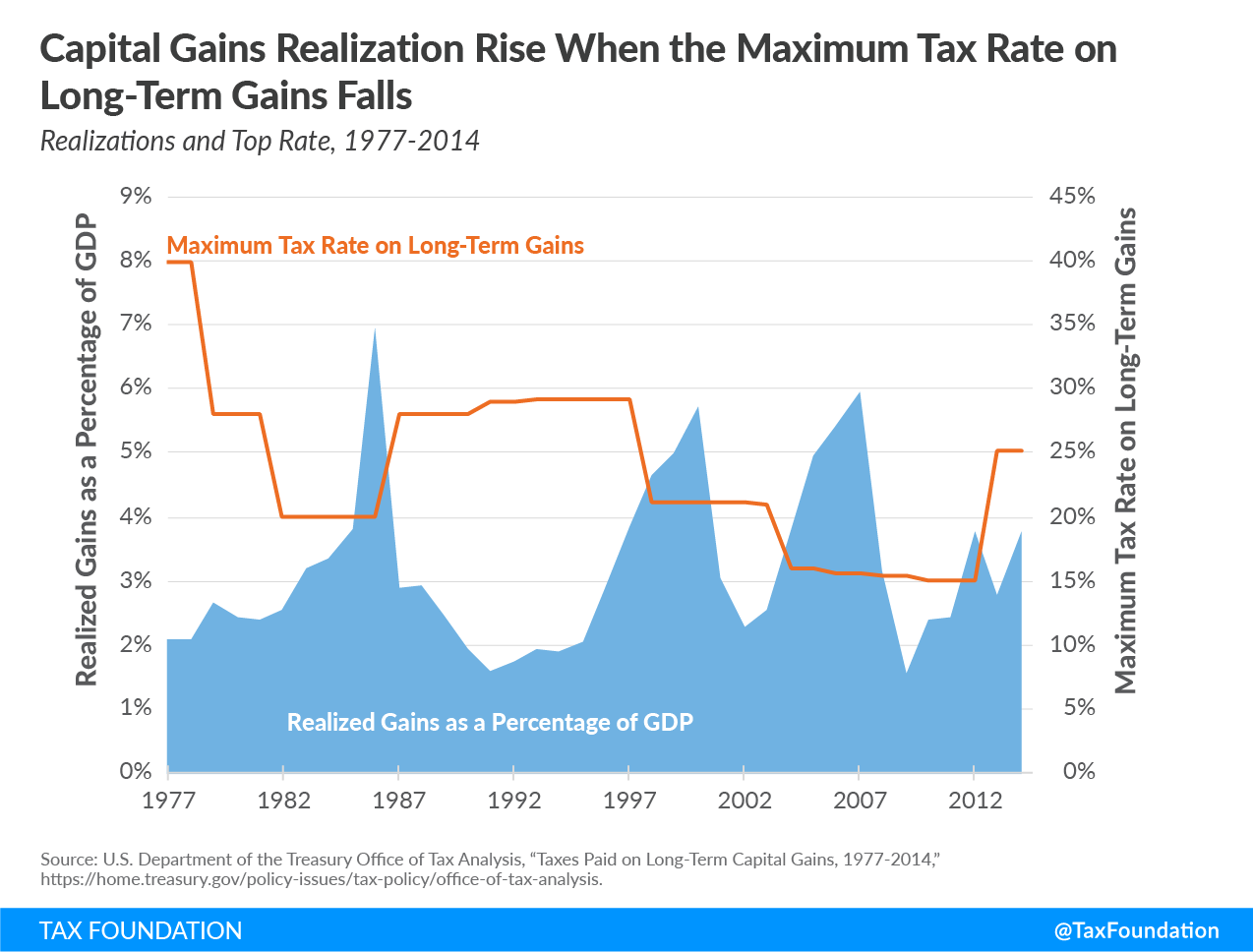

Capital gains tax has a dual impact on economic growth and inequality. On one hand, it can serve to moderate excessive speculation and encourage long-term investments, fostering stability in financial markets. On the other hand, it can disproportionately affect wealth accumulation among different income groups, potentially widening the gap between the wealthy and lower-income households. Higher capital gains taxes might deter investment, leading to slower economic growth. Conversely, lower rates could stimulate investment but risk increasing inequality, as wealthier individuals often derive a larger share of their income from investments.

Arguments for and Against Capital Gains Tax Reform

The debate surrounding capital gains tax reform is robust, presenting compelling arguments on both sides. Advocates for reform argue that the current tax structure is regressive and favors the wealthy. The unequal burden of capital gains tax can exacerbate wealth disparities, as higher rates can lead to tax avoidance strategies that primarily benefit affluent investors. Reforming capital gains taxation could promote a fairer tax system, ensuring that all citizens contribute equitably to national revenues.

Conversely, opponents of capital gains tax reform assert that higher taxes on capital gains could lead to reduced investment, hindering economic growth. They argue that capital gains taxes discourage savings and investment in businesses, which are vital for job creation. There is also a concern that frequent changes in tax policy can create uncertainty in financial markets, further slowing down economic activity.

The international approach to capital gains tax provides varied perspectives on how different countries integrate this tax into their economic policies. While some nations impose high capital gains tax rates, others adopt lower rates or even exempt certain long-term investments. For instance, the United States taxes capital gains at rates that can reach up to 20% for high earners, while countries like the United Kingdom tax capital gains at rates ranging from 10% to 28%, depending on income levels.

In many European countries, the capital gains tax is often integrated into broader wealth taxation systems, which also consider factors like inheritance and property taxes. For example, in Germany, long-term capital gains on shares held for more than a year are tax-exempt up to a certain threshold, incentivizing long-term investments. These diverse approaches illustrate how capital gains tax can be tailored to fit each nation’s economic landscape while aiming to balance growth with equity.

“The effectiveness of capital gains tax varies greatly depending on how it is implemented and the broader economic context in which it operates.”

Future Trends in Capital Gains Tax Legislation

As the economic landscape continues to evolve, so too does the framework surrounding capital gains tax legislation. In recent years, various proposals have emerged aiming to modify how capital gains are taxed, especially on high-income earners and businesses. This shift often mirrors broader economic trends, with debates that reflect societal priorities regarding wealth distribution and equity.

The current political climate, characterized by inflationary pressures and growing concerns over income inequality, suggests that capital gains tax rates may be on the verge of significant adjustments. Policymakers are increasingly considering measures that would increase tax rates on long-term capital gains for high earners, while potentially providing benefits to lower and middle-income investors. The implications of these changes could be far-reaching for both individual investors and businesses.

Implications for Investors and Businesses

Understanding the potential implications of these legislative changes is crucial for investors and business owners alike. A few key considerations are:

-

Increased tax rates for high-income earners could discourage investment in certain markets.

This might lead to a shift towards more tax-advantaged investment options or opportunities in tax-efficient funds.

-

Businesses may face higher taxation on the sale of appreciated assets.

This could result in altered strategies regarding asset management and the timing of divestitures.

-

Changes in legislation may incentivize holding investments longer.

Investors might lean towards strategies that emphasize long-term capital appreciation rather than short-term gains.

-

Potential credits or deductions for lower-income investors could emerge.

This may provide them with greater access to investment opportunities previously deemed unattainable.

Historical trends indicate that periods of economic improvement are often accompanied by tax reforms aimed at capital gains. For instance, following the economic recovery after the 2008 financial crisis, capital gains tax policies shifted to provide relief to investors. Given the current conditions, it is plausible to project that future adjustments will follow a similar vein, focusing on equity and accessibility while balancing revenue generation for government needs.

Capital Gains Tax and Real Estate Investments

Real estate investments can prove to be lucrative, but they come with unique considerations regarding capital gains tax. Understanding how capital gains tax impacts real estate transactions is crucial for investors looking to maximize their profits while minimizing tax liabilities. This segment will clarify how property appreciation affects tax obligations and Artikel strategies for deferring or reducing capital gains tax.

Appreciation of real estate plays a significant role in capital gains tax liability. When a property is sold for more than its purchase price, the difference is considered a capital gain. This gain is subject to taxation, and the rate depends on how long the property was held. Properties held for more than one year qualify for long-term capital gains rates, which are generally lower than short-term rates applied to properties held for less than a year. Here are some important points to consider:

Impact of Property Appreciation on Tax Liability

The appreciation of real estate can dramatically influence capital gains tax. As properties increase in value over time, the potential tax liability increases upon sale. For instance, if an investor purchases a property for $300,000 and sells it five years later for $500,000, the capital gain would be $200,000. Assuming this qualifies for long-term capital gains, the investor could benefit from a reduced tax rate compared to short-term capital gains.

To illustrate, here’s a breakdown of how appreciation affects tax liability:

- Purchase price: $300,000

- Sale price: $500,000

- Capital gain: $500,000 – $300,000 = $200,000

- Long-term capital gains tax rate (for example, 15%): $200,000 x 15% = $30,000 tax liability

This scenario highlights the importance of understanding the holding period and tax implications of property appreciation.

Strategies to Defer or Reduce Capital Gains Tax

Investors have several strategies at their disposal to defer or reduce capital gains tax when selling real estate. Taking advantage of these strategies can significantly impact overall tax liability and cash flow.

One popular method is the 1031 Exchange, which allows investors to defer taxes by reinvesting the proceeds from the sale of one investment property into another similar property. The IRS permits this exchange as long as specific criteria are met. Here are additional strategies to consider:

- Primary Residence Exclusion: If the property sold was your primary residence, you might exclude up to $250,000 ($500,000 for married couples) of capital gains if you’ve lived there for two out of the last five years.

- Offsetting Gains with Losses: You can sell other investments at a loss to offset realized capital gains. This strategy, known as tax-loss harvesting, can help minimize tax liability.

- Investing in Opportunity Zones: Investing in designated Opportunity Zones can allow investors to defer and potentially reduce capital gains tax on the investment profits.

- Installment Sales: Selling a property through an installment sale spreads out the gain over several years, thus potentially lowering the tax impact in any single year.

By utilizing these strategies, investors can effectively manage their capital gains tax liabilities while maximizing their real estate investment returns.

Comparisons of Capital Gains Tax Rates Across Different Countries

Capital gains tax rates vary significantly across the globe, reflecting each country’s economic policies and investment climates. Understanding these rates is crucial for investors looking to optimize their investment strategies. This analysis provides a comparative overview of capital gains tax rates in several countries, focusing on both short-term and long-term rates and their implications for global investment.

Capital Gains Tax Rate Comparison Table

The following table provides an overview of capital gains tax rates in select countries. This comparison highlights the differing approaches to taxation of investment income, which can greatly influence investor decisions.

| Country | Short-term Capital Gains Tax Rate | Long-term Capital Gains Tax Rate |

|---|---|---|

| United States | Up to 37% | 0% – 20% |

| United Kingdom | Up to 45% | 10% – 20% |

| Canada | Up to 53.53% | 50% of the gain is taxable |

| Germany | 26.375% | 26.375% |

| Australia | Up to 47% | 50% discount after one year |

| Singapore | 0% | 0% |

The variations in tax rates may influence investors’ preferences when considering where to allocate their resources. For instance, countries like Singapore, which impose no capital gains tax, tend to attract foreign investments, as they offer a more favorable environment for capital growth. Conversely, higher tax jurisdictions may deter investment or lead individuals to seek alternative options for their capital.

Implications of Varying Tax Rates on International Investments

The differences in capital gains tax rates across countries can greatly impact investment decisions. Investors may choose to relocate their investments to countries with lower tax liabilities to maximize their returns. This phenomenon, often referred to as “tax migration,” can lead to significant shifts in capital flows internationally.

The impact of capital gains tax rates can be illustrated as follows:

“Investors are more likely to invest in jurisdictions with lower tax burdens, as this can enhance overall net returns.”

Countries with aggressive capital gains tax policies might experience capital flight, where investors seek more tax-friendly environments. As a case in point, many technology startups and venture capitalists have gravitated towards countries like Singapore and Hong Kong, where tax incentives encourage innovation and investment.

Furthermore, multinational corporations often engage in tax planning strategies that leverage the differences in rates between jurisdictions. By strategically placing operations or investments in countries with lower capital gains taxes, companies can effectively reduce their overall tax liability. This behavior underscores the importance of understanding the global tax landscape when making investment choices and the necessity for continuous monitoring of policy changes across borders.

Case Studies on Capital Gains Tax Scenarios

The nuances of capital gains tax can significantly impact individual investors and corporations alike. Through examining real-life case studies, we can gain valuable insights into how various taxpayers have navigated their capital gains tax obligations and optimized their tax efficiency. These examples highlight the practical implications of capital gains tax and offer lessons on strategic planning and decision-making.

Real Estate Investment Profit Realization

In the case of a couple in California who purchased a home for $400,000 and sold it for $800,000, the capital gains tax implications were significant. They were eligible for the primary residence exclusion, which allowed them to exclude up to $500,000 of the gain from their taxable income. By utilizing this exclusion, they managed to minimize their tax liability, illustrating the importance of understanding available deductions.

The primary residence exclusion can provide substantial tax relief for homeowners, making it essential to stay informed about eligibility criteria.

Moreover, this couple utilized a 1031 exchange to defer capital gains tax on an investment property. By reinvesting the proceeds from selling their rental property into a similar property, they effectively postponed their tax obligations, demonstrating a strategic approach to capital gains.

Stock Market Investments and Tax-Loss Harvesting

Consider the case of an investor who actively traded stocks over the year. After realizing a $50,000 gain, they also recorded a $20,000 loss on other investments. By employing tax-loss harvesting techniques, they offset their capital gains with the losses, which resulted in a net taxable gain of only $30,000.

This strategy emphasizes the importance of timing in selling investments to manage tax burdens effectively.

Tax-loss harvesting allows investors to take advantage of losses to offset taxable gains, enhancing overall tax efficiency.

The investor’s decision to actively manage their portfolio and consider tax implications while trading underscores the benefits of being proactive in tax planning.

Business Sale and Capital Gains Tax Planning

A business owner who sold their small business for $2 million faced a substantial capital gains tax. By employing the Qualified Small Business Stock (QSBS) exclusion, they were able to exclude up to $10 million of gain from taxation, provided the stock met certain criteria. This case highlights the importance of understanding specific exemptions that can substantially reduce tax liability.

Strategically, the owner had also kept meticulous records of the business’s expenses and improvements, which allowed them to maximize their basis for calculating gains.

Utilizing exemptions like the QSBS can lead to significant tax savings, showcasing the necessity for business owners to engage in diligent tax planning.

This scenario serves as a reminder of the potential benefits of leveraging tax codes to one’s advantage during major financial transactions.

Investment in Qualified Opportunity Zones

An investor who recognized the potential of Qualified Opportunity Zones (QOZ) invested $100,000 in a business located in such a zone. After three years, the investment appreciated to $300,000. By holding the investment for the required period, the investor could defer taxes on the original gain and ultimately minimize their tax liability when selling.

This case demonstrates how strategic investment choices can yield substantial tax advantages while contributing to community development.

Investing in Qualified Opportunity Zones offers the dual benefit of tax deferment and community revitalization, representing a win-win situation.

Navigating capital gains tax through these examples showcases the value of strategic tax planning and the importance of staying informed about tax laws and available benefits.

Epilogue

In summary, capital gains tax plays a significant role in shaping investment behaviors and strategies. By understanding the implications of this tax, including available exemptions and upcoming legislative changes, investors can optimize their portfolios to maximize returns while minimizing liabilities.

Quick FAQs

What is the difference between short-term and long-term capital gains?

Short-term capital gains are profits from assets held for one year or less, taxed at ordinary income rates, while long-term capital gains are from assets held for more than one year, taxed at reduced rates.

Can capital losses offset capital gains?

Yes, capital losses can offset capital gains, reducing the overall taxable income from the sale of investments.

Are there any specific exemptions for capital gains tax on real estate?

Yes, homeowners may qualify for exemptions on capital gains tax up to a certain limit if they meet specific ownership and use criteria related to their primary residence.

How do different countries approach capital gains tax?

Countries vary widely in their capital gains tax rates and policies. Some have lower rates to encourage investment, while others may have a progressive structure based on income levels.

What strategies can investors use to minimize capital gains tax?

Investors often use strategies such as tax-loss harvesting, holding investments for longer to benefit from lower rates, and utilizing tax-advantaged accounts to minimize capital gains tax liabilities.