Withholding tax plays a crucial role in the taxation landscape, shaping how individuals and corporations manage their finances. This tax mechanism helps governments ensure that taxes are collected at the source before income reaches taxpayers, providing a steady revenue stream. Understanding its implications is essential not only for compliance but also for strategic financial planning.

The concept of withholding tax can be complex, with various types and applications depending on jurisdiction. From income tax withholdings on wages to taxes deducted from dividends, this system affects both local and international transactions, influencing investment decisions and business operations worldwide.

The Definition of Withholding Tax Must be Clearly Defined

Withholding tax plays a crucial role in the tax landscape by serving as a mechanism for governments to collect income taxes at the source. This system involves an automatic deduction of tax from income before it is disbursed to the recipient, ensuring that tax obligations are met in a timely manner. Understanding this concept is essential for both individuals and corporations as it affects cash flow and compliance with tax regulations.

Withholding tax is essentially a prepayment of income tax. It is primarily applied to various forms of income, including wages, salaries, dividends, interest, and payments to contractors and freelancers. The purpose of withholding tax is to ensure that the tax authorities receive tax revenue at the point of payment, reducing the risk of tax evasion. This system is significant as it simplifies the tax collection process and provides a steady stream of revenue for governments.

Scenarios Where Withholding Tax is Applied

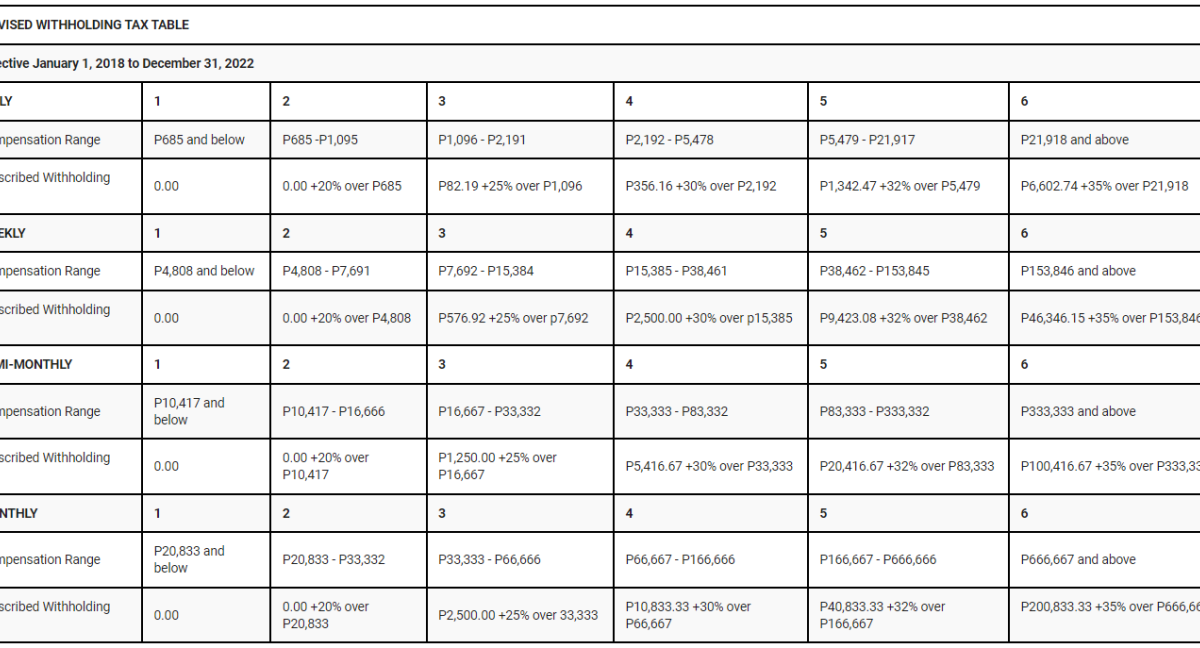

Various jurisdictions implement withholding tax differently, and the application can vary based on income type, residency status, and local regulations. Below are key scenarios illustrating the application of withholding tax in different contexts:

- Employee Salaries: In many countries, employers are required to withhold income tax from employees’ salaries. For example, in the United States, the IRS mandates that employers withhold federal income tax, Social Security, and Medicare taxes from employee paychecks, significantly impacting take-home pay.

- Dividends and Interest Payments: Corporations often face withholding tax on dividends paid to shareholders. In Canada, a withholding tax rate of 25% is generally applied to dividends paid to non-residents. This means that a U.S. investor receiving $1,000 in dividends would only receive $750 after tax deductions.

- Payments to Contractors: Many jurisdictions require businesses to withhold taxes on payments made to independent contractors. For instance, in the U.K., the IR35 legislation requires businesses to withhold income tax and National Insurance contributions from payments made to contractors, ensuring compliance with tax obligations.

The implications of withholding tax extend to both individuals and corporations. For individuals, it can result in a more predictable tax liability and help avoid a large tax bill at the end of the fiscal year. However, it also means less disposable income available immediately. For corporations, while withholding tax can simplify tax administration, it also requires careful monitoring to ensure compliance and avoid penalties.

“Withholding tax serves as a proactive measure not only for tax collection but also for fostering compliance and reducing the risk of tax evasion.”

Understanding the nuances of withholding tax is essential for effective financial planning and compliance, making it a significant aspect of both personal and corporate finance.

The Historical Context and Evolution of Withholding Tax Should Be Explored

The concept of withholding tax has deep historical roots, evolving significantly over time across various jurisdictions. Understanding its development is essential to grasp current taxation practices and their implications for taxpayers and governments alike. This evolution is closely linked to economic needs, government policies, and public perceptions.

Timeline of Withholding Tax Development

The establishment of withholding tax laws has been a gradual process influenced by various historical events and shifts in economic policy. Below is a timeline highlighting key milestones in the evolution of withholding tax across different countries:

- Ancient Civilizations: The earliest forms of tax collection can be traced back to ancient Egypt and Mesopotamia, where taxes were often collected at the source.

- 19th Century: The modern concept began to take shape in the late 1800s, particularly in Prussia and Austria, where income tax withholding was first enacted as a means to secure revenue.

- 1913 – United States: The U.S. introduced the Federal Income Tax, paving the way for the adoption of withholding tax in 1943 during World War II to ensure the government had necessary funds.

- 1960s – United Kingdom: The Pay As You Earn (PAYE) system was implemented, allowing for income tax to be withheld from salaries, a model that many other countries would later adopt.

- 1980s – Global Adoption: Many countries around the world began adopting withholding tax systems as a method to simplify tax compliance and improve revenue collection.

- 2010s – International Standardization: With the move towards global tax compliance initiatives, countries started aligning their withholding tax regulations to combat tax evasion and promote transparency.

Influence of Historical Events on Withholding Tax Practices

Historical events have played a pivotal role in shaping withholding tax practices. The following factors are significant:

- World Wars: Economic pressures during wartime necessitated immediate funding, leading to the establishment of withholding tax systems to streamline revenue collection.

- The Great Depression: The financial crisis of the 1930s prompted governments to seek more stable revenue sources, resulting in the introduction of withholding taxes in many economies.

- Globalization: As economies became increasingly interconnected, the need for standardized withholding tax regulations emerged to address cross-border income and enhance compliance.

Public Perception and Acceptance of Withholding Tax Over Time

The acceptance of withholding tax has evolved, influenced by economic conditions and public sentiment towards taxation. Historical insights reveal the following:

- Initial Resistance: When first introduced, many taxpayers viewed withholding tax as an infringement on their earnings, leading to resistance and protests in various countries.

- Gradual Acceptance: Over time, as individuals recognized the benefits of pre-collected taxes—such as reduced financial burdens during tax season—acceptance grew.

- Current Trends: Today, withholding tax is often seen as a practical solution for ensuring compliance and reducing tax evasion, although debates over fairness and transparency continue.

Different Types of Withholding Tax Must Be Identified and Explained

Withholding tax serves as an essential mechanism for governments to collect revenue before income is paid to taxpayers. It applies to various income sources, ensuring that tax obligations are met upfront. Understanding the different types of withholding tax is vital for both individuals and businesses to navigate their financial responsibilities effectively.

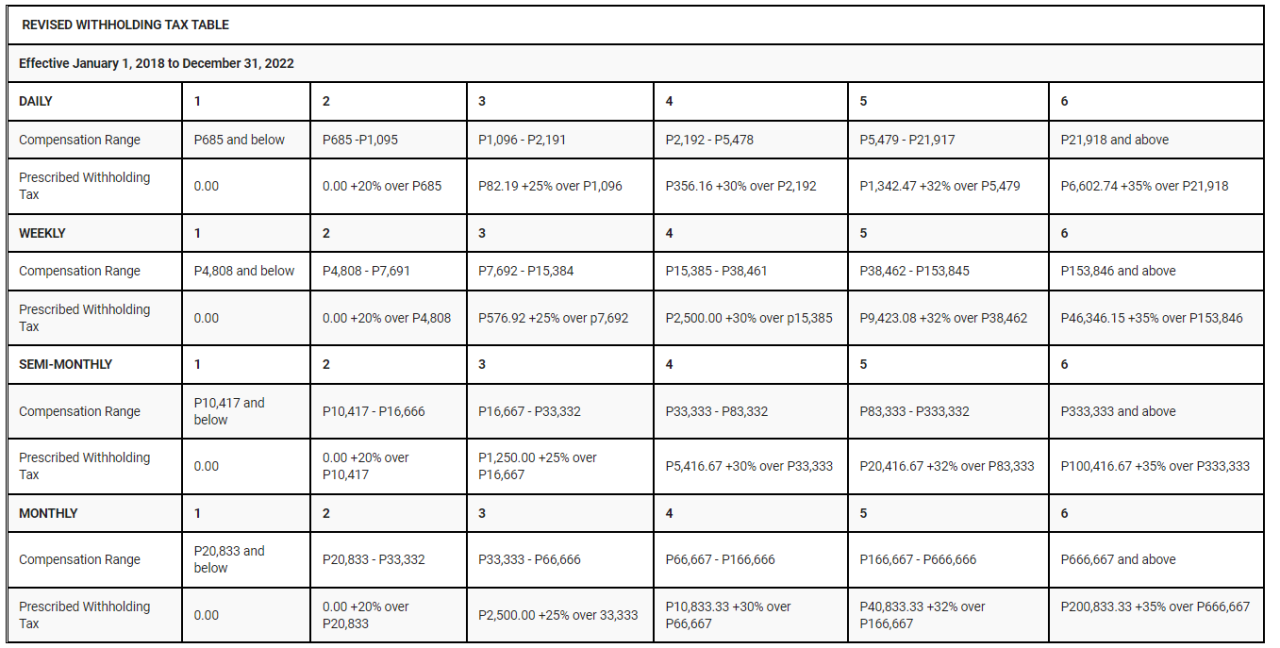

The classification of withholding taxes can generally be categorized into three main types: income tax, dividend tax, and payroll tax. Each type has distinct criteria that define its application, impacting both the payer and the recipient differently.

Income Tax Withholding

Income tax withholding applies to wages, salaries, and other forms of taxable income. Employers are responsible for deducting this tax from employees’ earnings before they receive their pay. The amount withheld typically depends on various factors, including income levels, marital status, and the number of dependents claimed by the employee.

To illustrate this type, consider a company where an employee earns $50,000 annually. If the applicable withholding rate is 20%, the employer deducts $10,000 from the employee’s earnings each year and remits it to the tax authorities. This ensures that the employee’s tax liability is settled incrementally throughout the year rather than in a lump sum during tax season.

Dividend Tax Withholding

Dividend tax withholding pertains to taxes on dividends paid to shareholders. Corporations are required to withhold a portion of dividend payments as tax before distributing them to investors. The withholding rate can vary based on the jurisdiction and the recipient’s tax status, such as whether they are domestic or foreign investors.

For example, a U.S.-based corporation paying a dividend of $1,000 to a foreign shareholder may withhold 30% of the payment as tax, translating to a $300 withholding. The remaining $700 is then distributed to the shareholder. This practice helps ensure that taxes are collected on dividend income before it reaches the investor.

Payroll Tax Withholding

Payroll tax withholding involves deductions for specific social insurance programs, such as Social Security and Medicare in the United States. Employers are charged with withholding these taxes from employee paychecks and must also contribute an equivalent amount.

Consider a scenario where an employee earns weekly wages of $1,000. If the applicable payroll tax rate for Social Security is 6.2% and Medicare is 1.45%, the employer withholds $62 for Social Security and $14.50 for Medicare, leading to a total withholding of $76.50. This ensures that both the employee’s and employer’s contributions are remitted to the government to fund these essential social programs.

“Withholding tax ensures a steady revenue stream for governments, allowing for the funding of public services and infrastructure.”

Through these examples, it becomes evident that while all types of withholding tax share the common goal of facilitating tax collection, they operate under different frameworks and serve distinct purposes in the tax system. Understanding these differences is crucial for compliance and effective financial planning.

The Role of Withholding Tax in International Taxation Should Be Analyzed

Withholding tax plays a crucial role in international taxation, significantly affecting cross-border transactions and the fiscal landscape for businesses operating globally. This tax mechanism is a pivotal element in minimizing tax evasion while ensuring that governments can collect tax revenue from foreign entities that generate income within their jurisdictions. Understanding its implications is essential for any international business navigating the complexities of global finance.

Withholding tax operates by requiring the payer of certain types of income to withhold a portion of that income and remit it to the tax authorities. This practice is particularly prevalent in cross-border transactions, where income such as dividends, interest, and royalties is paid to non-resident entities. The implications for businesses are profound, as they must navigate not only the withholding tax obligations in their home country but also in the countries where their income is sourced. This can lead to increased administrative burdens and cash flow considerations, as companies must account for the tax withheld before receiving the net amount.

Comparison of Withholding Tax Treaties

Withholding tax treaties between countries are designed to prevent double taxation and reduce the tax burden on cross-border income flows. These treaties typically establish reduced withholding tax rates on dividends, interest, and royalties, providing a framework for taxation that is more favorable to international businesses.

The specifics of these treaties can vary significantly between countries, influencing the effective tax rate for businesses engaged in cross-border transactions. For instance, a U.S. company receiving dividends from a subsidiary in the UK may benefit from a reduced withholding tax rate of 15% under the U.S.-UK tax treaty, compared to the standard UK withholding tax rate of 20%.

- Countries with comprehensive tax treaties are generally seen as more attractive for foreign investment.

- Understanding the terms of these treaties can lead to strategic tax planning, allowing businesses to optimize their tax liabilities.

- Failure to properly utilize these treaties can result in higher than necessary withholding taxes, impacting overall profitability.

Moreover, entities that are not familiar with the treaties may incur higher taxes than anticipated. Understanding and leveraging these treaties can provide significant tax savings; however, businesses must engage in thorough research or consult with tax professionals to ensure compliance and optimal tax treatment.

Best Practices for Navigating Withholding Tax Obligations

Navigating withholding tax obligations effectively is critical for international businesses to maintain compliance and minimize tax costs. To do so, companies should adopt specific best practices that can streamline their processes and enhance their understanding of the withholding tax landscape.

Establishing a robust framework for managing withholding tax involves several key strategies:

- Conducting regular training sessions for finance and tax teams to keep them informed on changes in tax laws and treaties.

- Employing tax technology solutions that can automate withholding calculations and reporting requirements.

- Maintaining a centralized database of all tax treaties relevant to the jurisdictions in which the business operates.

- Engaging with tax advisors who specialize in international tax issues to ensure compliance with local laws and maximize treaty benefits.

By adopting these best practices, businesses can effectively mitigate the risks associated with withholding tax, optimize their cash flow, and enhance their overall tax efficiency. A proactive approach is necessary as the international tax landscape continues to evolve, making it essential for companies to remain agile and informed.

The Impact of Withholding Tax on Investment Decisions Must Be Discussed

Withholding tax plays a crucial role in shaping investment strategies for both domestic and foreign investors. It is important to understand how these taxes can affect the overall return on investments and influence market dynamics. The implications of withholding tax extend beyond individual investment choices, impacting broader economic trends and investment behaviors.

Withholding tax can significantly alter the investment landscape by influencing both domestic and foreign investors’ decisions. For domestic investors, a higher withholding tax can deter investments in certain asset classes, leading to a reallocation of funds into more tax-efficient vehicles. On the other hand, foreign investors may evaluate withholding tax rates as a key factor in determining the attractiveness of a market. A country with lower withholding taxes could be perceived as more favorable, boosting foreign direct investment and enhancing market liquidity.

Influence of Withholding Tax Rates on Market Behavior

Different withholding tax rates can create varied market behaviors, impacting both investor sentiment and capital flows. The following points illustrate how these rates can shape investment patterns:

- Countries with a withholding tax rate of 15% for dividends may attract more foreign investments compared to those with rates as high as 30%. For example, a foreign investor receiving a 15% withholding tax will see a higher net return on dividends than if subjected to a 30% rate.

- In fixed-income securities, a lower withholding tax can make government bonds more appealing, thereby increasing demand. For instance, if a country offers a 10% withholding tax on bond yields, it may draw significant interest from international investors as opposed to a competing nation that taxes at 25%.

- Real estate investment trusts (REITs) in jurisdictions with favorable withholding tax arrangements can experience enhanced capital inflows. For instance, a REIT with a 15% withholding tax rate may outpace similar entities in higher-tax jurisdictions in attracting investors.

A thorough analysis of these various examples demonstrates the importance of withholding tax in influencing not just individual investment decisions but also the overall economic climate.

Tax Planning Strategies to Optimize Returns

Effective tax planning can mitigate the adverse effects of withholding tax and enhance investment returns. Investors can adopt several strategies to navigate these tax liabilities effectively:

- Utilizing tax treaties: Investors should explore existing tax treaties between their country of residence and the investment destination. These treaties often reduce withholding tax rates, allowing for better net returns.

- Investing through tax-efficient accounts: Utilizing retirement or tax-deferred accounts can help shield investments from immediate withholding tax, thereby compounding returns over time.

- Timing of investments: Strategic timing of investment purchases can allow investors to benefit from lower withholding tax rates applicable to certain periods, such as ex-dividend dates.

Incorporating these tax planning strategies not only aids in optimizing returns but also bolsters overall investment strategy, ensuring that withholding tax is effectively managed within an investor’s portfolio.

The Compliance Obligations Related to Withholding Tax Should Be Clearly Defined

Withholding tax compliance is a critical aspect of the tax obligations that employers and financial institutions must manage effectively. It involves the proper deduction and remittance of taxes from employee wages and certain payments to vendors or service providers. Clear definitions of these compliance obligations ensure that entities can navigate the complexities of withholding tax requirements without running into regulatory issues or penalties.

Employers and financial institutions hold significant responsibilities in ensuring compliance with withholding tax regulations. They must accurately calculate the withholding amounts, submit timely payments, and file necessary reports with tax authorities. Each entity is required to understand the specific regulations that apply to them based on the jurisdictions they operate in. This understanding includes knowing the correct tax rates, filing frequencies, and the types of payments that are subject to withholding.

Responsibilities of Employers and Financial Institutions

Employers are primarily responsible for withholding the correct amount of tax from employee wages, while financial institutions must manage withholding for interest, dividends, or other financial transactions. Both parties must maintain detailed records of transactions to support compliance and reporting requirements. The following checklist Artikels essential responsibilities:

- Ensure accurate calculation of withholding amounts based on current tax rates.

- Remit withheld taxes to the appropriate tax authorities by the deadlines.

- File required tax returns and reports, including W-2s, 1099s, or equivalent forms.

- Keep thorough records of payroll, withholdings, and remittances for at least seven years.

- Conduct regular training for staff involved in payroll and tax compliance processes.

To effectively manage tax obligations and avoid penalties, it’s crucial to be aware of the reporting and payment deadlines. Missing these deadlines can lead to interest charges and penalties that can significantly impact an organization’s finances. Below is a checklist of essential deadlines that entities need to adhere to:

Essential Reporting and Payment Deadlines

Timely adherence to deadlines is essential in preventing compliance issues. Below are critical reporting and payment deadlines relevant to withholding tax:

- Monthly: Deposits of withheld taxes generally due on the 15th of the following month.

- Quarterly: Filing of IRS Form 941 for employer’s quarterly federal tax return, due one month after the quarter ends.

- Annual: Filing of W-2s and 1099s by January 31st for the previous tax year.

- End of year: Employers must provide employees with their W-2 forms by January 31st.

Common Challenges in Meeting Withholding Tax Obligations

Taxpayers often encounter common challenges in meeting withholding tax obligations, which can stem from a variety of sources including regulatory changes, complex tax codes, and internal administrative errors. These challenges can lead to underpayment, overpayment, or even potential audits.

It is essential to stay updated on tax law changes to avoid non-compliance.

To address these challenges effectively, organizations can implement several solutions:

- Utilize accounting software that automatically updates tax rates and compliance requirements.

- Conduct regular audits of withholding processes and tax calculations to identify potential errors.

- Engage tax professionals or consultants to stay informed about legislative changes affecting withholding tax.

Organizations that prioritize compliance through a structured approach not only reduce the risk of penalties but also foster a culture of financial responsibility and transparency. By understanding their obligations and proactively managing their tax responsibilities, employers and financial institutions can maintain a solid standing with tax authorities and stakeholders.

Potential Reforms and Future Trends in Withholding Tax Need to Be Considered

In recent years, the landscape of withholding tax has undergone significant transformations influenced by globalization, digitalization, and evolving economic conditions. Countries are now revisiting their withholding tax policies to enhance revenue collection while ensuring fairness in taxation. This discussion highlights recent trends in withholding tax reforms globally, potential future changes, and expert insights on the direction of withholding tax.

Recent Trends in Withholding Tax Reforms

Countries around the world are implementing reforms to streamline their withholding tax systems in response to various driving forces, including economic pressures and the need for enhanced compliance mechanisms. Some notable trends include:

- Digital Economy Taxation: The rise of digital services has prompted many jurisdictions to rethink their withholding tax approaches. For example, countries like France and the UK have introduced measures to tax digital services at the source, leading to new withholding tax obligations for tech giants.

- BEPS Implementation: The OECD’s Base Erosion and Profit Shifting (BEPS) project has spurred reforms aimed at preventing tax avoidance through profit shifting to low-tax jurisdictions. Many countries are now harmonizing their withholding tax rates to align with international standards.

- Increased Transparency: Several nations have adopted measures to enhance transparency in withholding tax processes. Initiatives such as the Common Reporting Standard (CRS) require tax authorities to exchange information on withholding taxes, increasing compliance and reducing tax evasion.

Potential Future Changes and Their Impact

As trends evolve, several potential changes in withholding tax legislation are anticipated, which could significantly impact both taxpayers and governments. These changes could include:

- Uniform Withholding Tax Rates: There may be a push towards establishing uniform withholding tax rates internationally to simplify compliance for multinational corporations, reducing the risk of double taxation.

- Automated Tax Collection: The advancement of technology could lead to automated withholding tax systems that streamline tax collection processes, potentially reducing administrative burdens for taxpayers.

- Greater Focus on Equity: Governments may increasingly consider the equity of withholding tax systems, adjusting rates based on income levels to ensure fairness and reduce inequality.

Expert Insights and Forecasts

Experts predict that the evolution of withholding tax will continue to align closely with global economic developments and technological advancements. Some key insights include:

“The future of withholding tax will be shaped by our ability to adapt to new economic realities and technological innovations. Countries that successfully implement reforms will enhance their revenue systems while fostering a fairer tax environment.” – Tax Policy Expert

Analysts believe that as governments strive to close tax gaps, withholding tax reforms will likely remain a focal point in fiscal policy discussions. The growing emphasis on fairness and compliance will also drive reforms, with many countries expected to review their withholding tax thresholds and rates in the coming years.

Last Word

In conclusion, withholding tax is more than just a deduction on your paycheck; it encompasses a wide array of regulations that affect both personal and corporate finances. As tax laws evolve, staying informed about withholding tax implications will empower taxpayers to navigate their obligations effectively and optimize their financial strategies.

Question & Answer Hub

What is the purpose of withholding tax?

The main purpose of withholding tax is to ensure tax compliance by collecting taxes at the source of income, reducing the risk of tax evasion.

How does withholding tax vary by country?

Withholding tax rates and regulations can differ significantly by country, reflecting varying economic policies, tax treaties, and domestic laws.

Can individuals claim refunds on withheld taxes?

Yes, individuals may claim refunds on excess withholding taxes when they file their annual tax returns if their total tax liability is lower than the amount withheld.

What happens if an employer fails to withhold the correct amount?

If an employer fails to withhold the correct amount of tax, they may face penalties and be responsible for the unpaid taxes, including interest.

Are there exemptions to withholding tax?

Certain payments may be exempt from withholding tax, such as specific types of interest or dividends, depending on tax treaties and local laws.