Franchise tax is a crucial element in the business landscape that often flies under the radar. It’s not just another tax; it serves as a contribution to the economic health of states, influencing everything from public services to local development. With diverse regulations across different jurisdictions, understanding franchise tax is essential for businesses aiming for growth and compliance.

As we delve deeper into the complexities of franchise tax, we’ll unpack its history, significance, and the variations that exist from state to state. Businesses must navigate these waters carefully to ensure they meet their obligations while leveraging the opportunities that franchise tax can present.

Understanding the Basics of Franchise Tax

Franchise tax is a key component of the business taxation landscape. It represents a fee that businesses must pay for the privilege of operating in a certain jurisdiction. Unlike income tax, which is based on a company’s earnings, franchise tax is levied regardless of profitability, serving as a form of revenue for state and local governments. This tax can often be a source of confusion for business owners, particularly when navigating the complexities of compliance.

Historically, franchise tax has evolved significantly since its inception. Initially, it was introduced as a means for states to generate revenue from businesses that benefited from the infrastructure and services provided by the government. Over the years, the regulations and rates have changed, reflecting shifts in economic conditions and policy objectives. Each state in the U.S. has its own approach to franchise tax, leading to various calculations and reporting requirements. This evolution underscores the importance of staying informed about the specific obligations in each jurisdiction.

Differences Between Franchise Tax and Other Business Taxes

Business taxes can often create confusion, particularly when distinguishing between franchise tax and other forms of taxation such as income tax. Understanding these differences is crucial for compliance and effective financial planning.

Franchise tax is based on the right to operate a business in a specific state or locality, while income tax is calculated based on net earnings. Here are key distinctions:

- Basis of Taxation: Franchise tax is assessed on the operational privilege, whereas income tax is determined by the profits generated by the business.

- Tax Calculation: Franchise tax may be calculated using different methods, such as a flat fee, gross receipts, or a combination of factors. Income tax is generally based on a percentage of taxable income.

- Tax Reporting: Franchise taxes typically have separate filing requirements that may differ from income tax filings, leading to additional administrative tasks for businesses.

- Impact on Businesses: Franchise tax can be a fixed cost for businesses regardless of their profitability, while income tax directly correlates with the company’s financial performance.

The key takeaway is that while both franchise tax and income tax are essential for state revenue, they serve different purposes and impact businesses in distinct ways.

The Importance of Franchise Tax for Businesses

Franchise tax plays a pivotal role in the operational framework of businesses, particularly in the United States. It serves not only as a financial obligation but also as a critical component for assessing the health and longevity of a business entity. Understanding its importance is essential for any organization aiming for sustainable growth and compliance with state regulations.

Franchise tax impacts various facets of business operations, from funding initiatives to influencing investment decisions. Businesses are often required to pay this tax based on their revenue or net worth, which directly ties their success to tax obligations. This tax can affect liquidity, available resources for reinvestment, and overall financial planning. Companies that manage their franchise tax obligations effectively can leverage their good standing to attract investors and enhance their market reputation.

Significance of Compliance with Franchise Tax Obligations

Maintaining compliance with franchise tax obligations is crucial for any business, as it can lead to several notable outcomes. Here are the key considerations:

- Legal Standing: Compliance ensures that a business remains in good standing with state authorities, avoiding penalties and legal complications.

- Investment Opportunities: A clean tax record can enhance a company’s attractiveness to potential investors, facilitating access to capital.

- Operational Stability: Timely payment of franchise taxes can contribute to financial stability, allowing businesses to allocate resources effectively.

- Reputation Management: Businesses with a track record of compliance are better positioned in their industries, fostering trust among customers and partners.

Neglecting franchise tax obligations can lead to a range of serious consequences. The most immediate effect is the imposition of penalties, which can escalate quickly, burdening businesses with additional costs. Additionally, failure to comply can result in the revocation of business licenses, making it impossible for companies to operate legally.

“A failure to address franchise tax obligations can cost businesses not only financially but can also tarnish their reputation in the market.”

Moreover, businesses might face challenges in expanding or entering new markets if they have unresolved tax issues. Banks and investors may view outstanding tax obligations as a red flag, leading to decreased opportunities for financing and growth. Overall, the importance of franchise tax cannot be overstated; it is an integral part of maintaining a viable and successful business operation.

Variations in Franchise Tax Across States

Franchise tax is not a uniform tax applied across the United States; it varies significantly from one state to another. As a result, businesses must navigate a complex landscape of tax regulations that can influence their operational strategies and bottom lines. Understanding the differences in franchise tax rates and structures allows businesses to make informed decisions, particularly when operating in multiple jurisdictions.

State-specific regulations play a crucial role in determining how franchise tax is levied on businesses. Some states have a straightforward tax rate based on a flat percentage of a business’s revenue, while others utilize a more complex formula that may factor in the company’s assets or capital stock. These structural differences can create substantial disparities in tax liabilities for similar businesses operating in different states.

Tax Rates and Structures

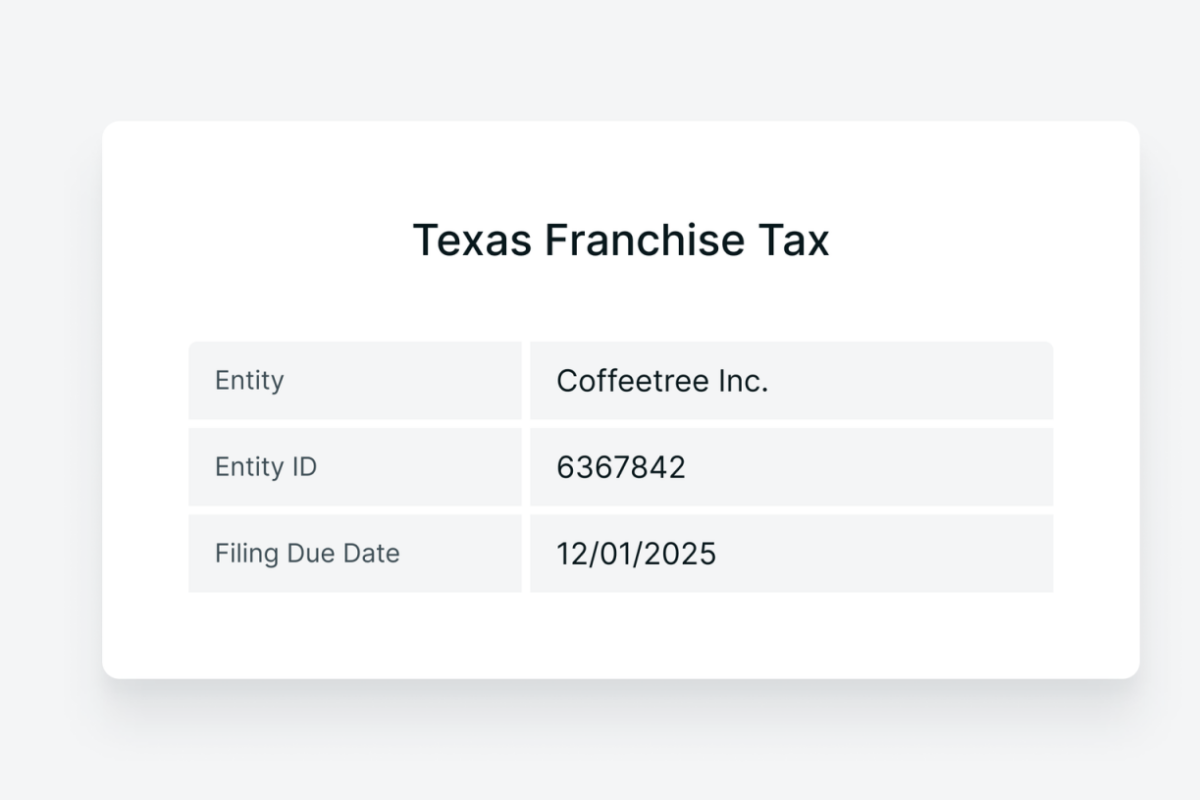

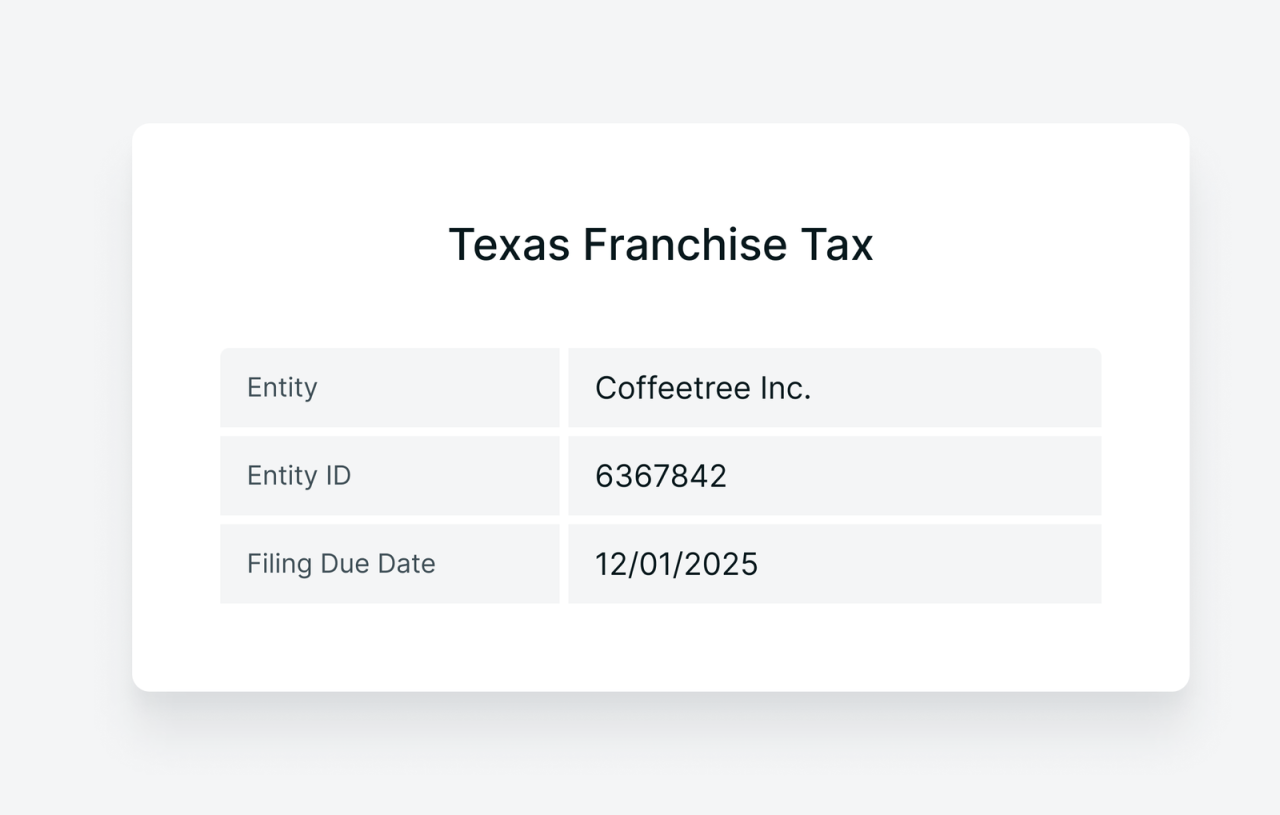

Analyzing the franchise tax rates and structures reveals a wide range of approaches. For example, Delaware is known for its business-friendly environment, imposing a minimal franchise tax based on the number of authorized shares, while Texas employs a margin tax that is calculated based on a business’s revenue after deductions. Below is a comparison of franchise tax structures in three states:

- Delaware: Offers a franchise tax that can be as low as $175 for small businesses but can escalate significantly based on the number of shares issued. This encourages many corporations to incorporate here due to the favorable treatment.

- Texas: Implements a franchise tax based on a business’s gross revenue, with rates ranging from 0.375% to 0.75%, depending on the revenue tier, making it one of the more complex structures.

- California: Charges a minimum franchise tax of $800 annually, regardless of the revenue, with additional taxes on a sliding scale for larger businesses, placing a financial burden on even the smallest entities.

Understanding these variations is critical for businesses seeking to optimize their operations across state lines. The differences can lead to varying tax liabilities which can influence where a business chooses to locate its operations or how it structures its corporate entity.

Impact on Multi-State Operations

For businesses operating in multiple states, franchise tax regulations can create intricate challenges. Each jurisdiction’s unique tax structure means that a business must comply with a patchwork of rules that may require substantial administrative resources and strategic planning. This complexity can also lead to unexpected costs and tax liabilities.

Key factors influencing the variation in franchise tax policies include local economic conditions, legislative priorities, and the desire to attract businesses to stimulate job growth. For instance, states with a robust manufacturing base may implement more favorable tax rates to attract companies in that sector. This targeted approach can significantly affect where businesses choose to invest and expand.

For example, when comparing states, a tech startup may find the tax incentives offered in Nevada more appealing compared to New York, where higher tax rates could erode potential profits.

The differences in franchise tax structures across states necessitate a careful analysis of each jurisdiction’s regulations to ensure compliance and optimize tax liabilities, enhancing the business’s overall financial health in the long term.

Determining Franchise Tax Liability

To accurately assess franchise tax liability, businesses must navigate a systematic approach that considers various financial factors. Understanding the specific requirements and methods of calculation is crucial, as missteps can lead to penalties or overpayments.

The first step in determining franchise tax liability involves gathering relevant financial documents. This includes reviewing annual revenue, assets, and any applicable deductions or credits. Each state may have unique regulations, so it’s essential to consult the specific guidelines that apply to the business’s location.

Steps for Assessment of Franchise Tax Liability

A structured method to assess franchise tax liability includes the following steps:

- Gather Financial Records: Collect all necessary financial records, including income statements, balance sheets, and previous tax returns. This data forms the basis for accurate calculations.

- Understand State Regulations: Each state has its own rules regarding franchise taxes, including rates and minimum thresholds. Familiarizing oneself with these regulations is key to compliance.

- Choose the Appropriate Calculation Method: Different methods may apply based on the business structure (C-corp, S-corp, LLC, etc.). It’s important to determine which method yields the lowest tax liability.

- Calculate the Tax: Using the chosen method, calculate the franchise tax due based on relevant financial metrics. Ensure all figures are accurate and accounted for.

- File the Tax Return: Submit the completed tax return along with any payments by the due date to avoid penalties.

Calculation Methods for Franchise Tax

Various calculation methods can be employed to determine franchise tax liabilities, and they often vary by state. Here are a few common methods:

- Gross Receipts Method: This method calculates the tax based on a percentage of the company’s gross receipts. For example, if a business has gross receipts of $1 million and the tax rate is 0.5%, the franchise tax would be $5,000.

- Net Income Method: This method utilizes the business’s net income for the tax calculation. For instance, a company with a net income of $200,000 and a tax rate of 1% would owe $2,000 in franchise tax.

- Fixed Dollar Amount: Some states impose a minimum franchise tax based on a fixed dollar amount. A business might be liable for a minimum of $800 regardless of its income or revenue.

Challenges in Reporting and Paying Franchise Taxes

Businesses often encounter several challenges when accurately reporting and paying franchise taxes. Understanding these obstacles can help in developing strategies to overcome them:

- Complexity of Regulations: The differing laws and rates in various states can be overwhelming, particularly for businesses operating in multiple jurisdictions.

- Data Accuracy: Ensuring all financial data is accurate is crucial; discrepancies can result in incorrect calculations and potential penalties.

- Late Payments and Penalties: Missing filing deadlines can lead to fines and interest charges, creating financial strain for businesses.

- Understanding Tax Credits: Many businesses overlook available tax credits or deductions, which can significantly reduce liability if properly applied.

Accurate reporting and timely payment of franchise tax are essential to maintaining good standing with state authorities and avoiding unnecessary penalties.

The Role of Franchise Tax in Economic Development

Franchise tax plays a crucial role in funding economic development initiatives at both state and local levels. The revenues generated from franchise taxes support various programs and services that nurture a thriving business environment, driving growth and prosperity. This discussion delves into how these tax revenues contribute to economic development, their relationship with public services, and provides case studies showcasing successful outcomes.

Franchise tax revenues are instrumental in financing various economic development programs. These funds are primarily allocated towards infrastructure improvements, workforce development, and local business support initiatives. By investing in these areas, states can enhance their attractiveness to businesses, foster innovation, and ultimately spur job creation. Additionally, these taxes ensure that local governments can maintain essential services that support a conducive environment for businesses to flourish.

Impact on Public Services Funded by Franchise Tax

The relationship between franchise tax and public services is a vital link in the economic development chain. Franchise tax revenues are often directed towards essential public services, which in turn support the local economy. These services may include:

- Infrastructure Development: Upgraded roads, bridges, and public transportation systems enhance connectivity and accessibility for businesses and residents alike.

- Education and Workforce Training: Funding for educational institutions and vocational training programs equips the workforce with necessary skills, increasing employability and productivity.

- Public Safety and Health Services: Investment in police, fire services, and healthcare facilities ensures a safe environment for businesses to operate and for residents to live.

- Community Development Initiatives: These programs promote local entrepreneurship, support small businesses, and encourage community engagement, fostering a strong local economy.

The effective use of franchise tax revenues to support public services leads to improved living standards, attracting both businesses and residents to the area.

Case Studies of Positive Economic Impact

Several regions have successfully utilized franchise tax revenues to catalyze economic growth. These case studies exemplify how strategic investment can lead to tangible benefits for local economies.

One notable example is Texas, where franchise taxes contribute significantly to the Economic Development Fund. This fund supports various initiatives, such as the Texas Enterprise Fund, which provides financial incentives to companies that commit to creating jobs in the state. As a result, Texas has witnessed substantial job creation and an influx of businesses, making it one of the fastest-growing states in the U.S.

Another case is California, where franchise tax revenues have been directed towards enhancing public infrastructure. The state invested heavily in improving transportation networks and public spaces, which has bolstered tourism and local business performance. Cities like San Francisco and Los Angeles have seen revitalization of neighborhoods and increased property values, demonstrating a direct correlation between franchise tax investment and local economic growth.

In summary, franchise tax revenues are pivotal in fostering economic development through strategic investment in public services and infrastructure. The successful case studies from Texas and California showcase the potential impact of well-managed franchise tax funds on local economies, emphasizing the importance of these taxes in promoting sustainable growth.

Strategies for Managing Franchise Tax Obligations

Navigating franchise tax obligations can be a daunting task for many businesses. However, with the right strategies, companies can effectively manage and potentially reduce their franchise tax burden. This guide Artikels practical approaches to enhance compliance, streamline record-keeping, and emphasizes the importance of seeking professional advice.

Effective Strategies for Reducing Franchise Tax Burden

Implementing strategic measures can significantly minimize franchise tax liabilities. Businesses can adopt the following strategies to achieve this goal:

- Choose the Right Business Structure: Selecting a business structure that aligns with your financial goals can lead to lower taxation. For instance, LLCs often face different tax liabilities compared to corporations.

- Incentives and Credits Utilization: Take advantage of available tax incentives and credits offered by state tax authorities. This may include credits for job creation or investing in specific areas.

- Reviewing Allocation Methods: Assessing the allocation of income and expenses can lead to a more favorable tax outcome. Businesses should ensure that they are not over-reporting income in higher-tax jurisdictions.

Record-Keeping and Documentation for Compliance

Maintaining comprehensive records is pivotal for franchise tax compliance. Proper documentation can safeguard against audits and disputes, as well as ensure accurate filings.

- Maintain Accurate Financial Records: Keep detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements, well-organized and updated to reflect true business performance.

- Document Business Activities: Record all business transactions thoroughly, including invoices, receipts, and payroll records. This documentation is crucial for substantiating income and expenses during tax assessments.

- Track Tax Payments and Filings: Maintain a log of all tax payments made, including dates and amounts, as well as copies of all filed tax returns to ensure consistency and accuracy.

Importance of Seeking Professional Advice

Navigating the complexities of franchise tax can be overwhelming, making it essential for businesses to seek professional guidance. Engaging tax advisors or accountants who specialize in franchise tax can provide valuable insights and strategies.

Professional advice can help identify specific deductions and credits that a business may overlook, ultimately leading to significant tax savings.

- Stay Updated on Tax Law Changes: Tax legislation is subject to change, and professionals can keep businesses informed about the latest developments that may affect their tax obligations.

- Avoiding Penalties: Expert advice can help businesses avoid common pitfalls that result in costly penalties and interest on unpaid taxes.

- Customized Tax Strategies: Tax professionals can create tailored strategies based on a business’s unique circumstances, improving compliance and reducing tax exposure.

Current Trends and Future Outlook on Franchise Tax

Franchise tax has seen significant shifts in recent years, driven by changes in economic climates, regulatory reforms, and business practices. As companies adapt to evolving tax landscapes, understanding emerging trends is crucial for strategic planning. This segment delves into contemporary trends and anticipates future developments in franchise tax policies, offering insights on their implications for businesses.

Emerging Trends in Franchise Tax Policies

Recent years have witnessed several trends in franchise tax policies. One notable trend is the increasing scrutiny of tax incentives provided to businesses. Governments are reassessing the effectiveness of these incentives, often resulting in tightened eligibility criteria. This trend emphasizes accountability and encourages businesses to align their operations with broader economic goals.

Another trend is the shift towards greater transparency in tax reporting. Many states have begun implementing requirements for businesses to disclose more detailed information about their tax obligations. Enhanced transparency not only fosters trust between governments and taxpayers but also aids in the identification and prevention of tax evasion.

Potential Changes in Legislation

Legislative changes are on the horizon that could significantly impact franchise tax structures. One potential change is the introduction of digital service taxes, which target businesses providing online services. This shift is driven by the need to tax increasingly digital economies and could lead to higher franchise taxes for companies operating in this space.

Additionally, several states are exploring the implementation of a minimum tax on franchise fees, aimed at ensuring that all businesses contribute to state revenues, regardless of their revenue levels. Such measures could particularly affect small businesses, prompting them to reassess their tax strategies.

Future Outlook and Implications for Businesses

The future landscape of franchise tax is likely to be shaped by ongoing economic and technological developments. Companies may need to prepare for a more dynamic tax environment that incorporates not only traditional revenue models but also the complexities of digital transactions.

For instance, as remote work becomes more prevalent, states may seek to tax businesses based on their workforce location rather than solely their physical presence. This could lead to disparities in tax obligations depending on employee residency, necessitating businesses to adopt more sophisticated tax compliance strategies.

In light of these trends, businesses should consider the following strategies:

- Regularly review and adapt their tax planning strategies to remain compliant with changing regulations.

- Invest in tax technology solutions to enhance reporting capabilities and ensure transparency.

- Engage with tax professionals to navigate complex legislative changes and optimize tax positions.

As the landscape continues to evolve, proactive engagement with tax policies will be essential for businesses to remain competitive and financially sustainable.

Last Word

In conclusion, navigating the world of franchise tax is vital for business sustainability and growth. Understanding the implications of this tax not only helps in compliance but also opens doors for potential investments and economic development. As regulations continue to evolve, staying informed on franchise tax will empower businesses to thrive in an ever-changing landscape.

Answers to Common Questions

What is franchise tax used for?

Franchise tax revenues typically fund state and local public services, including education, infrastructure, and economic development programs.

Who is liable for franchise tax?

Generally, any business entity that operates within a state that imposes a franchise tax is liable, including corporations and certain partnerships.

Can franchise tax rates change each year?

Yes, franchise tax rates can be adjusted by state legislatures, so businesses should stay updated on any changes that may impact their tax obligations.

Is franchise tax the same as income tax?

No, franchise tax is typically based on a business’s operational presence in a state, while income tax is based on the profits generated by the business.

Are there exemptions for franchise tax?

Some states offer exemptions or reduced rates for certain types of businesses or specific industries, so it’s important to check state regulations.