Kicking off with Tax expense, this topic holds a crucial position in the realm of finance, influencing both the bottom line of companies and the broader economic landscape. Understanding tax expense is essential not only for accountants but for anyone involved in financial decision-making. This essential concept impacts net income, shapes financial health, and varies significantly across different business types.

Tax expenses represent the taxes owed by a business based on its taxable income and are a critical component of financial statements. They reflect the company’s obligations to the state and can vary depending on numerous factors, including the type of business, applicable tax laws, and jurisdictional regulations. A clear grasp of tax expenses enables better financial planning and more informed strategic decisions.

Understanding the concept of tax expense and its significance in financial statements

Tax expense represents the amount a company must pay in taxes for a specific period based on its taxable income. This expense is crucial because it directly affects a company’s net income and ultimately determines the profitability reported on financial statements. Tax expense is calculated by applying the relevant tax rates to the company’s taxable income, as defined under tax laws. It encompasses various factors such as current taxes owed and deferred tax liabilities, which arise from differences in accounting rules and tax regulations. This makes understanding tax expense essential for stakeholders who analyze financial health and performance.

The role of tax expense in accounting extends beyond mere compliance with tax laws; it fundamentally influences a company’s financial statements, particularly the income statement. The tax expense is subtracted from the pre-tax income, impacting the net income reported. A higher tax expense results in a lower net income, which may affect investor perceptions and market valuations. Conversely, if a company effectively manages its tax liabilities through legal tax planning strategies, it may enhance its net income and overall financial health.

Variations in tax expense reporting across different business types

Tax expense reporting can vary significantly depending on the type of business entity. Here are some examples illustrating how different businesses may report tax expenses:

- C Corporations: These entities are taxed separately from their owners. They report tax expenses based on the federal corporate tax rate, which can lead to double taxation when dividends are distributed to shareholders. For instance, if a C Corporation generates $1 million in taxable income, it may incur a tax expense of $210,000 if the corporate tax rate is 21%.

- S Corporations: In contrast, S Corporations usually pass through income to shareholders, who report it on their personal tax returns. Consequently, the S Corporation itself does not incur a federal tax expense, but the shareholders pay taxes on their share of the income. This structure can lead to lower overall tax liability for the business.

- Partnerships: Similar to S Corporations, partnerships do not pay income taxes at the entity level. Instead, partners report their share of the partnership’s income on their individual tax returns. The tax expense is thus effectively borne by the individual partners based on their respective ownership percentages.

The method of reporting tax expense also varies based on the jurisdiction and specific tax laws applicable to the business. For example, businesses operating internationally must navigate complex tax regulations, including transfer pricing rules, which can significantly affect their tax expense reporting. A multinational corporation may report a lower tax expense in a country with favorable tax incentives, impacting its overall financial statement representation significantly.

Different types of tax expenses and how they are categorized

Tax expenses play a fundamental role in the financial operations of individuals and businesses alike. Understanding the different types of tax expenses and their categorizations can help taxpayers effectively plan and manage their financial obligations. By recognizing the various taxes they may be liable for, taxpayers can ensure compliance and make informed decisions regarding budgeting and investments.

Tax expenses can be classified into several categories, with income tax, property tax, and sales tax being the most prevalent types. Each category has its own unique characteristics, applicable rates, and implications for taxpayers. The classification of these taxes is essential for both reporting purposes and understanding how they impact overall financial health.

Classification of tax expenses

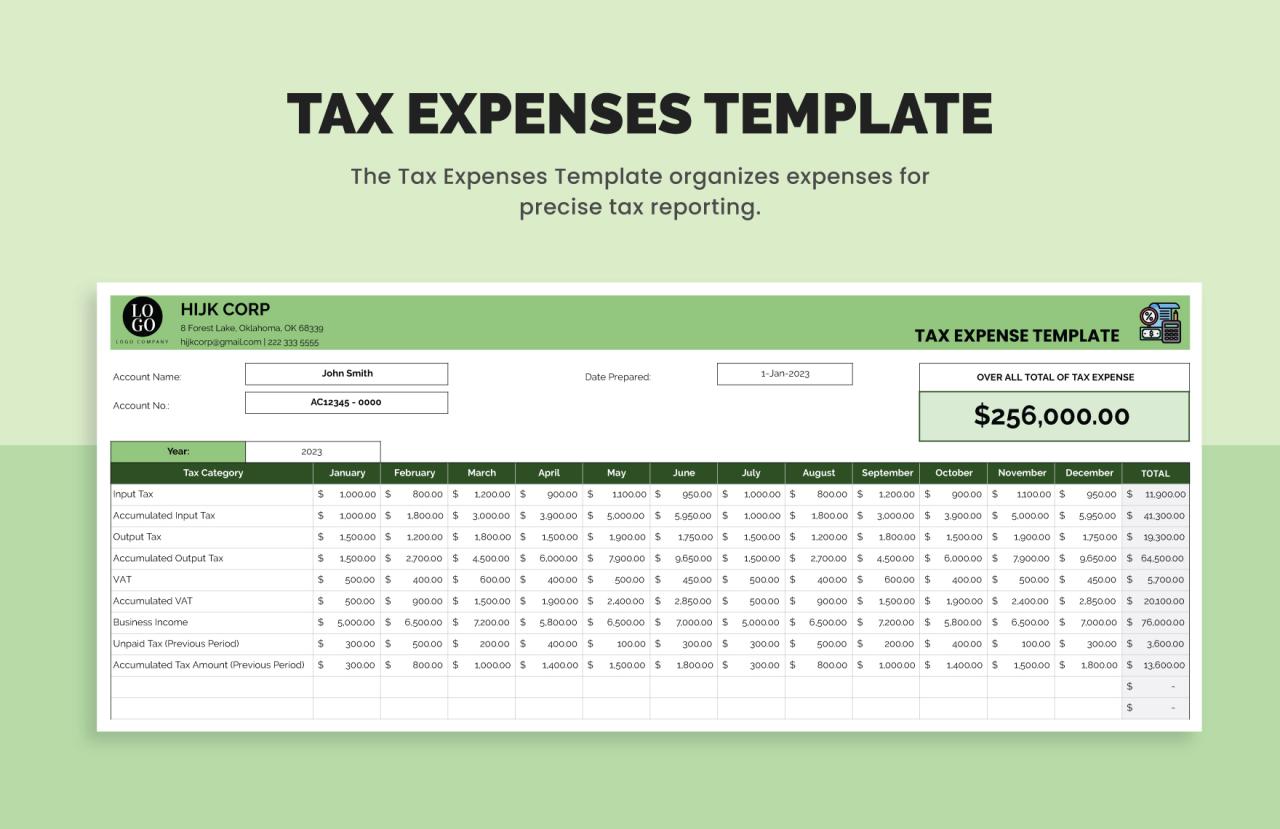

The following table presents the primary categories of tax expenses along with examples to illustrate each type:

| Type of Tax | Description | Examples |

|---|---|---|

| Income Tax | Tax on an individual’s or business’s earnings. | Federal income tax, state income tax, corporate tax |

| Property Tax | Tax based on property ownership, typically levied on real estate. | Residential property tax, commercial property tax |

| Sales Tax | Tax imposed on the sale of goods and services. | State sales tax, local sales tax |

Tax expenses are significantly influenced by jurisdiction and regulatory changes. Different states or countries may have varying tax rates and rules, which can modify the overall tax burden on individuals and businesses. For example, a change in federal tax regulations can lead to adjustments in state income taxes, impacting how much an individual or entity ultimately pays. Additionally, local governments may impose taxes that affect property values and purchases.

Taxpayers must stay informed about these changes to optimize their tax planning strategies. Ignoring jurisdictional variations can lead to missed opportunities for deductions or credits that could lessen tax liabilities. Furthermore, understanding regional tax laws is essential for ensuring compliance and avoiding penalties.

“Tax planning is essential for minimizing liabilities and ensuring compliance with evolving regulations.”

Tax expense calculations and common methods used in accounting practices

Calculating tax expenses is a critical aspect of financial accounting that directly impacts a company’s profitability. Businesses must accurately assess their tax obligations to ensure compliance and optimize their financial strategies. This discussion will focus on the methods commonly used to calculate tax expenses and highlight the significance of tax planning in minimizing liabilities.

Methods for Calculating Tax Expenses

Tax expenses can be calculated using various methods, primarily the effective tax rate and marginal tax rate. Understanding these methods is crucial for companies to manage their tax responsibilities effectively.

The effective tax rate is the average rate at which a corporation’s pre-tax profits are taxed. This rate can be calculated using the formula:

Effective Tax Rate = Total Tax Expense / Pre-tax Income

For example, if a company reports a total tax expense of $300,000 and a pre-tax income of $1,000,000, the effective tax rate would be 30%. This metric provides a clear picture of the overall tax burden on a business’s income.

In contrast, the marginal tax rate refers to the tax rate that applies to the last dollar of income earned. This rate is particularly important for strategic decision-making, as it influences how new income is taxed. For instance, if a company’s income increases and pushes it into a higher tax bracket, understanding this marginal rate helps assess the impact of additional earnings.

Tax planning plays a vital role in ensuring that businesses minimize their tax expenses legally. Effective strategies may include:

- Utilizing tax deductions and credits to lower taxable income.

- Deferring income to future periods to take advantage of lower tax rates.

- Investing in tax-efficient assets that generate favorable tax treatment.

To illustrate how different revenue levels impact tax expenses, consider two companies. Company A generates $500,000 in pre-tax income, resulting in an effective tax rate of 20%, yielding a tax expense of $100,000. Company B, with a pre-tax income of $1,500,000, may face a marginal tax rate of 35% on income above $1,000,000. Therefore, if its tax expense is calculated using the effective rate of 30%, it would owe $450,000. These examples demonstrate how tax liabilities escalate with increased income, emphasizing the need for proactive tax planning and management.

The relationship between tax expense and deferred tax assets and liabilities

The dynamic between tax expense and deferred tax assets and liabilities is a crucial part of corporate finance and accounting. Understanding this relationship helps stakeholders assess a company’s future tax obligations and cash flows. Both tax expenses and deferred tax items play significant roles in the overall financial health of an organization, as they directly influence net income and, consequently, the financial statements.

Deferred tax assets and liabilities arise from temporary differences between the accounting income reported on financial statements and the taxable income reported on tax returns. The accounting principles that govern deferred taxes are primarily rooted in the matching principle and the income tax allocation principle. These principles state that income tax expenses should be matched to the revenues they help to generate, regardless of when the cash payment is made. Consequently, companies recognize deferred tax assets for deductible temporary differences and deferred tax liabilities for taxable temporary differences.

For example, consider a scenario where a company has a warranty provision that is recognized in its financial statements as an expense, leading to reduced accounting income. However, for tax purposes, this expense is not recognized until the warranty claims are paid. This creates a temporary difference where accounting income is lower than taxable income, resulting in a deferred tax asset. Conversely, if a company has accelerated depreciation on its tax return compared to its financial statements, it will report lower taxable income initially, creating a deferred tax liability.

To illustrate the impact of temporary differences on tax expense, let’s look at a simplified example. Assume a company has an accounting income of $100,000, but due to temporary differences, its taxable income is $80,000. The applicable tax rate is 25%. The company’s tax expense would be calculated as follows:

Tax Expense = Taxable Income x Tax Rate = $80,000 x 25% = $20,000

In this scenario, the tax expense reflects the lower taxable income, while the difference between the accounting income and taxable income highlights the deferred tax assets or liabilities that will be accounted for in future periods. This interplay of financial reporting and tax obligations emphasizes the importance of understanding tax expense in the context of deferred tax assets and liabilities.

Analyzing the implications of changes in tax legislation on tax expenses

Tax legislation is a dynamic element that significantly influences the financial landscape for both individuals and corporations. Changes in tax laws can lead to immediate shifts in tax expenses, impacting how much taxpayers owe to the government. Understanding the implications of these changes is crucial for effective financial planning and compliance. New tax regulations can arise from different motivations, including economic stimulus, budget deficits, or social equity considerations.

The impact of tax legislation can vary widely, depending on the specific provisions enacted. For instance, tax reforms may introduce new deductions, alter tax rates, or change eligibility criteria for tax credits. Such modifications can either increase or decrease tax liabilities for taxpayers. Significant tax reforms often align with broader economic goals, and their effects can ripple across various income brackets, influencing spending habits, investments, and overall economic growth.

Historical Examples of Significant Tax Reforms

To better understand the impact of tax legislation changes, it’s important to evaluate historical examples. The Tax Reform Act of 1986 in the United States is one of the most notable reforms. This act aimed to simplify the tax code, closing loopholes and reducing the number of tax brackets. As a result, the top tax rate was reduced from 50% to 28%, while the bottom rate remained at 11%. This led to an increase in tax expenses for higher-income individuals but provided significant relief for middle-income earners.

Another example is the Tax Cuts and Jobs Act (TCJA) of 2017, which significantly lowered corporate tax rates from 35% to 21%. This reform was intended to spur economic growth by encouraging businesses to reinvest profits. However, while corporations benefited, many individuals faced limitations on itemized deductions, which altered tax expenses across different income levels.

The following comparison chart illustrates pre- and post-legislation tax expenses for various income brackets during the TCJA implementation:

| Income Bracket | Pre-TCJA Tax Expense | Post-TCJA Tax Expense |

|---|---|---|

| $50,000 | $8,500 | $7,500 |

| $100,000 | $18,000 | $15,000 |

| $500,000 | $168,000 | $126,000 |

| $1,000,000 | $339,000 | $290,000 |

Changes in tax laws have substantial implications for tax expenses, and analyzing these shifts provides valuable insights for future financial strategies. Understanding prior reforms and their outcomes enables individuals and corporations to adapt effectively to new tax environments, ensuring compliance and optimizing tax liabilities.

The influence of tax expense on investment decisions and corporate strategy

Tax expense plays a significant role in shaping investment decisions and corporate strategies, impacting both domestic and foreign environments. Companies often evaluate how tax obligations will influence their profitability and cash flow, which are pivotal for sustaining operations and growth. This consideration is especially crucial in our increasingly globalized economy, where tax rates vary widely across jurisdictions and can substantially alter the attractiveness of potential investments.

The influence of tax expenses is evident when companies are deciding where to allocate resources for new projects, expansions, or even mergers and acquisitions. For instance, corporations might favor countries or states with lower corporate tax rates, thereby enhancing their net income and providing a competitive advantage. A prime example is seen with many tech companies establishing operations in countries like Ireland, where favorable tax regimes have attracted significant foreign direct investment.

Additionally, tax strategies can lead to shifts in corporate behavior. Companies might engage in tax planning strategies, such as restructuring their corporate entities or altering their supply chains to minimize tax liabilities. For example, some firms may choose to set up holding companies in jurisdictions with minimal tax exposure, allowing them to manage their worldwide income more efficiently. This strategic maneuvering not only affects their immediate financials but also influences their long-term investment outlook.

When investors evaluate potential investments, tax expenses are a crucial factor in their decision-making process. Here are key considerations:

- Effective tax rate: Investors assess the overall tax burden a company faces relative to its earnings.

- Tax incentives: The presence of tax credits or deductions that can enhance a company’s profitability.

- Geographical tax implications: Understanding how different jurisdictions tax corporate profits impacts valuation.

- Regulatory changes: Investors must consider potential shifts in tax legislation that could affect future profitability.

- Historical tax trends: Analyzing past tax liabilities to predict future tax expenses and stability.

Incorporating these factors helps investors gauge risk and potential return on investment more accurately.

Understanding tax expense reporting in different accounting frameworks

Tax expense reporting is a crucial aspect of financial statements, reflecting a company’s tax obligations in a given period. Different accounting frameworks, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), have distinct approaches to recognizing and measuring tax expenses. Understanding these differences is essential for stakeholders who rely on accurate financial reporting.

Under GAAP, tax expenses are reported based on the concept of “current” and “deferred” taxes. Current tax is determined by applying the statutory tax rate to taxable income for the period, while deferred taxes arise from timing differences between accounting income and taxable income. GAAP emphasizes a systematic and rational allocation of tax expenses to the periods in which the related income is recognized. The balance sheet approach is used, focusing on the future tax consequences of current transactions.

In contrast, IFRS adopts a more principle-based approach to tax expense recognition. Similar to GAAP, it distinguishes between current and deferred taxes but emphasizes the “temporary differences” between the carrying amounts of assets and liabilities and their tax bases. IFRS requires entities to recognize deferred tax liabilities for all taxable temporary differences, with fewer exceptions compared to GAAP. This results in a potentially more comprehensive recognition of deferred tax assets and liabilities, affecting the overall tax expense reported.

Key differences in tax expense recognition and measurement

Understanding the key differences in tax expense recognition and measurement between GAAP and IFRS is critical for financial analysis. Here are some notable distinctions:

- Recognition of Deferred Taxes: GAAP allows for some exceptions to recognizing deferred tax assets, particularly if there is uncertainty about their realization. IFRS, however, requires recognition of deferred tax liabilities for all taxable temporary differences, leading to potentially more extensive reporting.

- Measurement of Tax Rates: Under GAAP, the enacted tax rates in effect at the reporting date are applied to deferred tax assets and liabilities. IFRS also applies this but may allow for more flexibility in reflecting changes in tax law or rates within the measurement period.

- Tax Rate Changes: GAAP requires adjustments to deferred tax assets and liabilities when tax rates change, impacting the income tax expense immediately. IFRS similarly mandates adjustments but may allow for a broader interpretation regarding the timing of recording these changes.

The implications of these differences can significantly impact financial statements. For instance, a company reporting under IFRS may show a higher deferred tax asset on its balance sheet, enhancing its net income due to recognizing more future tax benefits. Conversely, under GAAP, a company might report a more conservative view of its tax position, leading to lower immediate tax expense recognition. Ultimately, the choice of accounting framework can influence the perceived financial health of an organization, affecting investment decisions and stakeholder trust.

Summary

In summary, the intricacies of tax expenses encompass not only their calculation and categorization but also their broader implications on corporate strategies and investment decisions. As tax legislation evolves, understanding tax expenses becomes increasingly vital for businesses aiming to maintain financial stability and optimize their tax positions. By navigating the complexities associated with tax expenses, companies can enhance their financial health and adapt to changing economic environments.

Question & Answer Hub

What is tax expense?

Tax expense is the total amount of taxes that a company is obligated to pay based on its taxable income, impacting its net income and financial health.

How is tax expense calculated?

Tax expense is typically calculated using the effective tax rate or marginal tax rate, which reflects the proportion of income paid in taxes.

Why is tax expense important for businesses?

Tax expense is vital as it affects a company’s net income, influencing decisions related to investments, budgeting, and overall financial strategy.

Can tax expense vary by industry?

Yes, different industries may have varying tax obligations due to specific regulations, tax incentives, and deductions applicable to their operations.

How do tax changes impact future expenses?

Changes in tax legislation can lead to significant fluctuations in tax expenses, altering financial forecasts and impacting strategic planning for businesses.