Tax rate plays a crucial role in shaping economic landscapes, influencing everything from individual behavior to international business strategies. As countries navigate the complexities of their tax systems, the variations in tax rates emerge as a fascinating topic, revealing how these differences can impact economies globally. Understanding tax rates is not just about numbers; it’s about the broader implications for growth, investment, and social equity.

From the effects on disposable income to the psychological influences on consumer behavior, tax rates significantly shape how individuals and businesses operate. Moreover, the ongoing assessment of progressive versus regressive tax systems invites discussions on social justice and equity. Looking ahead, the rise of the digital economy presents unique challenges for tax policies, emphasizing the need for continual reform in response to technological advancements.

The significance of tax rate variations across different countries

Tax rates play a crucial role in shaping the economic landscape of countries, directly influencing business operations, investment decisions, and overall economic growth. Understanding the variations in tax rates among different nations is imperative for multinational corporations and investors. These differences stem from a multitude of factors including governmental policies, economic conditions, and societal needs. Countries implement tax rates not just to generate revenue, but also to attract or deter foreign investments, thus affecting global trade dynamics.

Several factors contribute to the discrepancies in tax rates across the globe. Economic stability, the level of development, and public sector needs are overarching influences. For instance, countries with emerging economies might impose lower tax rates to attract foreign direct investment (FDI), while developed nations may have higher rates to support extensive social welfare programs. Additionally, political stability, economic policies, and the country’s regulatory environment also dictate tax levels.

Impact of Tax Rates on International Business Operations

Tax rates significantly affect international business operations. High taxes can discourage foreign investments, while lower taxes can create a favorable environment for companies looking to expand globally. Businesses must evaluate tax implications when choosing operational jurisdictions, affecting decisions on where to establish headquarters, production facilities, or R&D centers. The following points illustrate how tax rates can influence international business:

– Cost of Doing Business: Higher tax rates increase operational costs, prompting companies to seek locations with more favorable tax environments. For example, Ireland’s corporate tax rate of 12.5% has attracted numerous tech giants like Google and Apple, fostering a robust tech ecosystem.

– Profit Repatriation: Companies often consider how taxes affect profit repatriation. Countries with lower withholding taxes on dividends, such as Singapore, encourage businesses to return profits to their home country.

– Regulatory Compliance: Different countries have varying compliance requirements tied to their tax systems. Complex tax structures can lead to increased administrative burdens, making businesses reconsider investments in such jurisdictions.

– Market Access: Nations with competitive tax rates may enhance market attractiveness, drawing businesses looking to expand their operations. For instance, countries in Eastern Europe offer lower taxes, which can boost foreign investments aimed at accessing both local and EU markets.

– Tax Incentives: Some countries actively offer tax incentives for specific industries or activities. For example, Germany provides tax breaks for R&D activities, fostering innovation and drawing tech firms.

In summary, tax rate variations are not merely numbers; they are strategic tools that shape international business landscapes and influence economic growth worldwide. Countries continually adjust their tax policies to remain competitive in the global market, highlighting the need for businesses to stay informed and agile.

The impact of tax rates on individual income and spending behavior

Tax rates play a crucial role in determining an individual’s disposable income, which in turn influences spending behavior and overall economic activity. As tax rates vary, so does the amount of income individuals have available to spend or save. Understanding this relationship is essential for grasping the broader economic implications of tax policy.

The correlation between tax rates and consumer spending is significant. When tax rates are high, individuals face a reduction in their disposable income. This decrease may lead to reduced consumer spending as individuals prioritize essential expenses over discretionary spending. For example, a household earning $50,000 annually and facing a 30% tax rate would have only $35,000 left for consumption after taxes. Conversely, if the tax rate were lowered to 20%, the household would enjoy $40,000 in disposable income, potentially leading to increased spending on goods and services. As disposable income rises, consumer confidence often improves, resulting in a positive feedback loop where increased spending boosts economic growth.

The psychological effects of tax rates on savings and investments

Tax rates can also have profound psychological effects on individual behavior regarding savings and investments. Higher tax rates may create a perception that saving is less rewarding, leading to a lower savings rate among individuals. When people anticipate that a significant portion of their returns will be taxed, they may be less inclined to invest in certain financial instruments or savings accounts. This is particularly evident in investment vehicles like stocks, where capital gains taxes can deter individuals from seeking higher-risk opportunities.

Additionally, low tax rates can foster a more positive outlook on personal finance, encouraging individuals to save and invest more. In environments where tax incentives are provided for saving—like retirement accounts with tax-deferred growth—individuals may feel more motivated to contribute. For instance, the U.S. 401(k) plans allow individuals to save money before taxes are deducted, effectively reducing their taxable income in the present and promoting long-term savings behavior.

In summary, the impact of tax rates on individual income is multifaceted, affecting not just disposable income but also the psychological factors that drive spending, saving, and investing behavior. The interplay between tax policy and consumer behavior illustrates the importance of considering tax rates in broader economic discussions.

Tax rate adjustments during economic recessions and recoveries

During periods of economic downturns, governments often resort to tax rate adjustments as a critical strategy to stimulate growth and recovery. This approach allows them to manage public finances effectively while responding to varying economic conditions. In times of recession, lower tax rates can provide individuals and businesses with additional disposable income, thereby stimulating consumption and investment. Conversely, during recoveries, governments may adjust tax rates to ensure sustainable growth and fiscal responsibility. Understanding the historical context of tax rate changes during major recessions, along with examining case studies, provides valuable insights into the effectiveness of these strategies.

Strategies for tax rate adjustments

Governments have employed various strategies when adjusting tax rates in response to economic changes. Key approaches include:

- Temporary tax cuts: Many governments implement temporary reductions in income and corporate taxes during recessions to encourage spending and investment. These cuts are often accompanied by expiration dates to manage fiscal sustainability.

- Targeted relief measures: Specific tax reliefs, such as credits and deductions for certain sectors or demographics, aim to provide targeted support to those most affected by economic downturns.

- Increased public spending: In some cases, governments may not lower tax rates but instead increase public spending funded by borrowing, aiming to stimulate economic activity indirectly.

- Tax incentives for investment: Offering tax breaks or incentives for businesses to invest in infrastructure and job creation can spur economic growth, especially in recovery phases.

Historical context of tax rate changes during major recessions

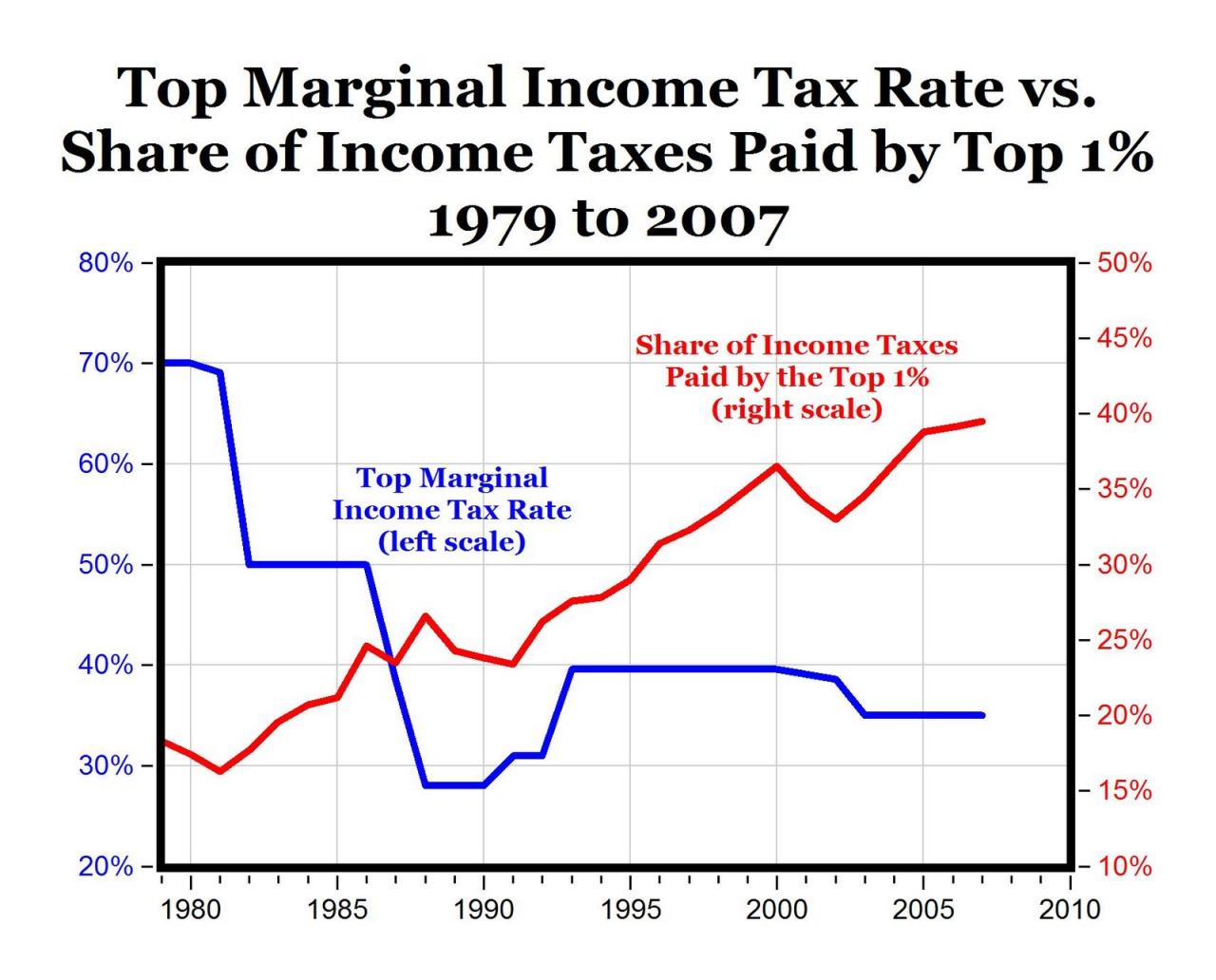

Throughout history, significant recessions have prompted notable tax rate adjustments. For instance, during the Great Depression of the 1930s, the U.S. government raised income tax rates in an attempt to balance budgets amidst declining revenues. However, this move stifled growth and was later reversed under President Franklin D. Roosevelt with the introduction of the New Deal, which featured tax cuts aimed at stimulating the economy.

Similarly, during the 2008 financial crisis, the U.S. government enacted the Economic Stimulus Act, which included tax rebates for individuals and businesses. This approach was intended to increase consumer spending and mitigate the recession’s impacts. The effectiveness of these adjustments can be seen in the subsequent recovery, which although slow, demonstrated positive growth trends.

Countries such as Japan also provide illustrative examples. In response to prolonged economic stagnation in the 1990s, Japan implemented various tax reforms, including reductions in corporate tax rates. These measures aimed to encourage business investment and ultimately helped to foster a gradual economic recovery.

Case studies of effective tax rate adjustments

Examining specific instances where tax rate adjustments successfully stimulated economic recovery highlights the efficacy of these strategies.

- Sweden’s tax reforms: In the early 1990s, Sweden faced a severe economic crisis characterized by high unemployment and inflation. The government enacted significant tax cuts, particularly for corporations, alongside a focus on reducing public spending. This approach revitalized business confidence and led to a robust recovery.

- Germany post-2008: Following the global financial crisis, Germany implemented tax reductions and increased public investment in infrastructure. These initiatives not only boosted domestic demand but also positioned Germany for a strong recovery, resulting in one of the fastest-growing economies in Europe in the years following the crisis.

- United States Tax Cuts and Jobs Act (2017): Although enacted during a period of economic expansion, this act significantly reduced corporate tax rates with the intent to spur growth and encourage repatriation of foreign earnings. The immediate effects included increased corporate investments and a temporary boost in economic activity, setting a precedent for future tax adjustment discussions.

The role of tax rates in promoting or discouraging foreign investment

Tax rates play a critical role in shaping the landscape of foreign investment. Countries often adjust their corporate tax rates to create an appealing environment for international businesses. Tax incentives can be a powerful tool in attracting foreign direct investment (FDI), while high tax rates may deter potential investors. Understanding the intricate relationship between corporate tax rates and FDI is essential for policymakers aiming to enhance their nation’s economic growth through foreign capital.

The relationship between corporate tax rates and foreign direct investment is complex yet vital for understanding investment flows. Lower corporate tax rates can create substantial incentives for foreign businesses to invest in a country. Companies often seek to minimize their tax burdens, and favorable tax conditions can significantly influence their decision-making processes. For instance, multinational corporations may establish operations in countries with lower tax rates to enhance their profitability. Conversely, countries with high tax rates risk driving away potential investors, as the increased costs can harm their competitive edge.

Countries such as Ireland and Singapore serve as prime examples of how tax policy can effectively attract foreign investment. Ireland has maintained a corporate tax rate of only 12.5%, which has drawn numerous tech giants and pharmaceutical companies to set up their European headquarters there. This policy has contributed significantly to Ireland’s economic growth and job creation, showcasing the effectiveness of lower tax rates in attracting FDI.

On the other hand, countries like France have struggled with high corporate tax rates, which historically reached upwards of 33%. Although recent reforms have aimed to reduce these rates, the lingering effects of the past have made it challenging to attract the same level of foreign investment as their lower-tax counterparts. Investors often weigh tax rates alongside other factors, such as labor market conditions and political stability. This multifaceted decision-making process means that a competitive tax environment is crucial but not solely sufficient for attracting FDI.

Furthermore, tax incentives, such as tax holidays or credits, can sweeten the deal for foreign investors. Countries like Hungary, which has one of the lowest corporate tax rates in Europe at 9%, have leveraged such incentives to attract businesses in various sectors, including technology and manufacturing. These strategies not only enhance foreign investment but also stimulate local economies by creating jobs and fostering innovation.

In summary, while tax rates are a pivotal element in attracting foreign investment, they must be part of a broader strategy that includes business-friendly regulations and a robust infrastructure. The interplay of these factors ultimately shapes a country’s ability to draw in foreign capital, making tax rates a critical consideration in economic policy formulation.

Understanding progressive vs. regressive tax systems

Tax systems play a crucial role in shaping economic equality and social justice. Two primary types of tax systems are progressive and regressive, each with distinct mechanisms that impact various income groups differently. Understanding these differences is essential for recognizing how tax policy can influence societal equity and individual financial well-being.

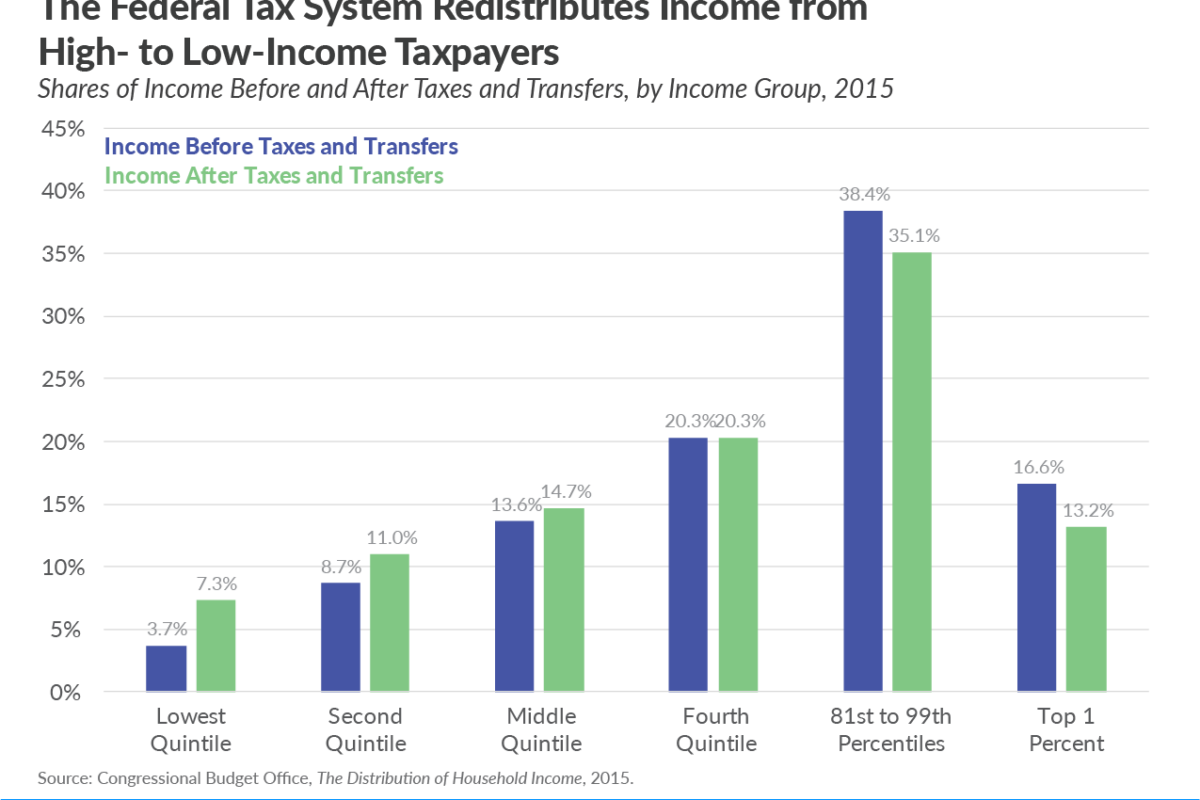

Progressive tax systems are designed so that the tax rate increases as the taxable income increases. This means that individuals with higher incomes pay a larger percentage of their income in taxes compared to those with lower incomes. For example, in the United States, federal income tax rates range from 10% for lower-income brackets to 37% for the highest earners. This type of taxation aims to redistribute wealth and reduce income inequality, ensuring that the burden of financing government services is distributed more fairly among citizens. The implication for lower-income groups is that they retain a larger portion of their earnings, which can improve their standard of living and contribute to overall economic growth.

Effects on different income groups

In contrast, regressive tax systems impose a uniform tax rate regardless of income level, meaning that lower-income individuals pay a higher percentage of their income in taxes compared to higher earners. Taxes such as sales taxes and certain excise taxes fall under this category, as they take a larger share of income from those who earn less. For instance, a flat sales tax of 10% means that a person earning $30,000 will spend a higher proportion of their income on taxes than someone earning $300,000. This system can exacerbate income inequality, as it places a heavier burden on lower-income families, limiting their disposable income and economic mobility.

The implications of these tax structures extend to social equity and justice. Progressive taxation can promote social welfare by funding public services, education, and infrastructure that disproportionately benefit lower-income communities. Conversely, regressive taxation can lead to wider disparities in wealth and access to services. A balanced tax system that incorporates both principles may offer a solution to ensure fairness while fostering economic growth and equity among diverse income groups.

The future of tax rates in the digital economy

As the digital economy continues to expand, it brings with it a host of challenges and opportunities for tax policy. The rapid advancement in technology and the proliferation of online businesses are reshaping traditional concepts of taxation. Governments around the world are grappling with how to adapt their tax systems to effectively capture revenue from digital transactions. This ongoing evolution requires a nuanced understanding of both the existing framework and the innovative approaches that could be employed to address the unique circumstances surrounding digital transactions.

Challenges in Taxing Online Transactions and Services

The rise of the digital economy presents significant hurdles for governments attempting to tax online transactions effectively. One major challenge lies in the global nature of digital services. Unlike traditional businesses, which have a physical presence in specific jurisdictions, many digital companies, such as e-commerce giants and streaming services, operate across borders without maintaining a tangible footprint. This makes it difficult for tax authorities to determine where value is created, leading to potential tax base erosion.

Another challenge arises from the diversity of digital business models. Whether it’s a subscription service, an online marketplace, or app-based services, each model may require a different approach to taxation. Furthermore, the constant evolution of technology means that new business models emerge frequently, often outpacing existing regulations.

Governments also face significant difficulties in enforcing compliance. Many digital companies utilize complex supply chains and pricing strategies that obscure the actual flow of revenue. This opacity poses challenges for tax administrations trying to ensure that businesses are paying their fair share. Moreover, the ability of companies to shift profits to low or no-tax jurisdictions complicates the situation further, as it reduces the tax revenue available to governments in their home countries.

The issue of data privacy also intersects with tax collection efforts. Striking a balance between ensuring taxpayers’ compliance and protecting sensitive financial data is a delicate task. As governments seek to modernize their tax systems to be more aligned with digital transactions, they must also consider the implications of data sharing and privacy regulations.

To tackle these challenges effectively, potential reforms in tax rates and structures could be introduced. Countries might consider implementing digital services taxes (DST) specifically targeting large tech companies that generate substantial revenue within their jurisdictions. Such taxes would focus on the value derived from users in a particular country, ensuring that companies contribute to the local economy.

Countries could also explore the concept of a unified approach to digital taxation, such as the OECD’s Inclusive Framework on Base Erosion and Profit Shifting (BEPS). This initiative aims to establish a global consensus on how to tax digital services, ensuring that tax rights are fairly allocated among countries.

In conclusion, the future of tax rates in the digital economy hinges on the ability of governments to adapt to the rapid changes in technology and business practices. By addressing the unique challenges posed by online transactions and considering potential reforms, nations can work towards creating a fair and effective tax system that reflects the realities of a digital world.

State and local tax rate variations within a country

Tax rates can vary dramatically not only between countries but also within different regions and states of the same nation. This variation is often influenced by local policies, economic conditions, and the needs of the community. As a result, understanding these differences is crucial for evaluating the economic landscape and potential migration patterns.

The significance of state and local tax rates cannot be overstated, as they play a pivotal role in shaping the economic environment of a region. High tax rates in certain states can deter potential residents and businesses, while lower rates can attract them. For instance, states like California and New York impose some of the highest income tax rates in the country, creating a burden for high earners. Conversely, states such as Texas and Florida have no state income tax, making them appealing destinations for individuals and families seeking a lower tax burden.

Impact on Migration Patterns and Local Economies

The variations in tax rates significantly influence migration patterns and have profound effects on local economies. People often relocate to states with favorable tax environments, leading to population shifts that can enhance or diminish local economic activity.

Consider the case of New York, which has a top income tax rate of about 10.9%. This high tax burden can lead to an exodus of wealthy individuals and businesses to states like Florida, where the lack of state income tax is a strong incentive. This trend has been observed in recent years, with many high earners leaving New York for the sunny beaches of Florida, resulting in a decrease in local spending and investment in New York while boosting Florida’s economy.

Additionally, states with lower tax rates often experience economic growth. For example, Texas has seen a surge in job creation and economic activity due to its favorable tax climate. Companies like Oracle and Tesla have relocated their headquarters to Texas, attracted by its no-income-tax policy and business-friendly regulations. This influx not only creates jobs but also stimulates local economies through increased demand for housing, services, and infrastructure.

The implications of these tax rate variations extend beyond individual tax burdens. They can shape a state’s overall economic trajectory, impact public services funding, and dictate the quality of life for residents. A growing population in low-tax states can lead to overcrowded infrastructure, necessitating increased spending on public services, which in turn may prompt future tax adjustments.

In summary, the interplay between state and local tax rates and migration patterns is a dynamic component of a country’s economy, continuously influencing where people choose to live and work. The outcomes of these variations are evident in the economic vitality of regions, driven by the decisions of individuals and businesses reacting to their fiscal environments.

Closure

In conclusion, the exploration of tax rates unveils intricate connections between economic health, individual behavior, and international relations. As governments adapt their strategies to optimize tax rates, the potential for fostering foreign investment and driving economic recovery becomes evident. Ultimately, understanding tax rates is essential for grasping the complexities of our global economy and navigating the challenges of an ever-evolving financial landscape.

FAQs

What is a tax rate?

A tax rate is the percentage at which an individual or corporation is taxed on their income, profits, or property.

How do tax rates affect economic growth?

Tax rates can influence investment decisions, consumer spending, and overall economic activity, impacting growth positively or negatively.

What is the difference between a progressive and a regressive tax system?

A progressive tax system imposes higher rates on higher income earners, while a regressive tax system takes a larger percentage from low-income earners.

How do changes in tax rates influence consumer behavior?

Changes in tax rates can affect disposable income, altering spending and saving habits among consumers.

What role do tax incentives play in attracting foreign investment?

Tax incentives can lower costs for foreign businesses, making a country more attractive for investment and economic activity.

How do local tax rates impact migration patterns?

Significant differences in local tax rates can drive residents to move to areas with more favorable tax conditions, affecting local economies.