Beginning with Deferred tax, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Deferred tax refers to the taxes that are assessed but not yet paid due to timing differences between when a transaction occurs and when it is recognized for tax purposes. This concept is crucial in accounting, as it impacts businesses’ financial statements and tax obligations. By understanding deferred tax, companies can better manage their resources and forecast their financial health more accurately. Examples abound, as deferred tax can arise from various situations such as depreciation differences and changes in inventory valuation.

Understanding the Concept of Deferred Tax

Deferred tax is a crucial concept in accounting that relates to the differences between the accounting income and the taxable income of a business. It arises from timing differences in the recognition of income and expenses between financial accounting and tax regulations. Essentially, it represents the tax impact of future taxable income that will be recognized in the current period, but for which the cash payment has been deferred. The significance of deferred tax lies in its ability to provide a more accurate picture of a company’s financial health and performance by aligning income tax expenses with the revenues they generate.

The implications of deferred tax can be seen in various business scenarios. For instance, if a company invests in capital assets, it may be eligible for tax deductions through depreciation. However, for financial reporting, the company might use a different method of depreciation that results in higher profit figures in the short term. This discrepancy leads to the recording of deferred tax liabilities, as the company will eventually pay more taxes in future periods when the depreciation expense on the tax return is lower. Similarly, deferred tax assets can arise when a company incurs losses or expenses that are recognized for tax purposes but not yet for accounting purposes.

In the financial statements of corporations, deferred tax plays a pivotal role. For instance, deferred tax assets and liabilities are shown on the balance sheet, indicating potential future tax benefits or obligations. The income statement reflects the income tax expense that incorporates the effects of deferred tax, providing stakeholders with insights into the company’s current and future tax liabilities. These elements help investors gauge the sustainability of earnings, as understanding deferred taxes allows them to assess how tax strategies might impact future cash flows. In summary, deferred tax not only affects the financial positioning of a business but also plays a vital role in financial planning and strategy.

Examples of Deferred Tax Situations

Deferred tax can arise in various scenarios that illustrate its complexity and significance. Some common examples include situations involving:

- Depreciation Differences: A manufacturing company might use accelerated depreciation for tax purposes while opting for straight-line depreciation for financial reporting, creating a deferred tax liability.

- Tax Loss Carryforwards: If a business incurs a loss in one fiscal year, it can carry that loss forward to offset taxable income in future years, resulting in a deferred tax asset.

- Revenue Recognition: A software company may recognize revenue upon signing a contract for financial reporting, yet receive payment later, leading to the need for deferred tax accounting.

- Provisions and Reserves: If a company sets aside funds for future expenses, such as warranty claims, that are not yet tax-deductible, it establishes deferred tax liabilities.

Deferred tax calculations provide businesses with a strategic advantage in tax planning and financial management.

The Mechanism of Deferred Tax Assets and Liabilities

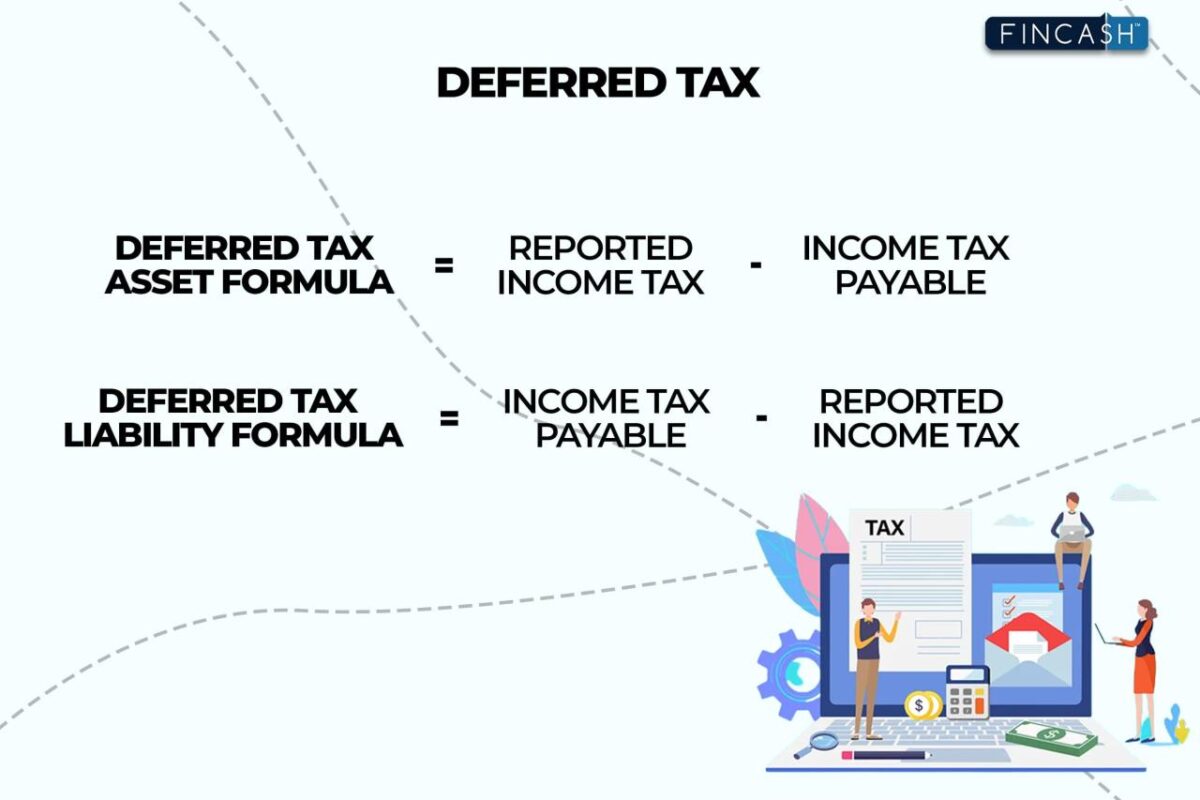

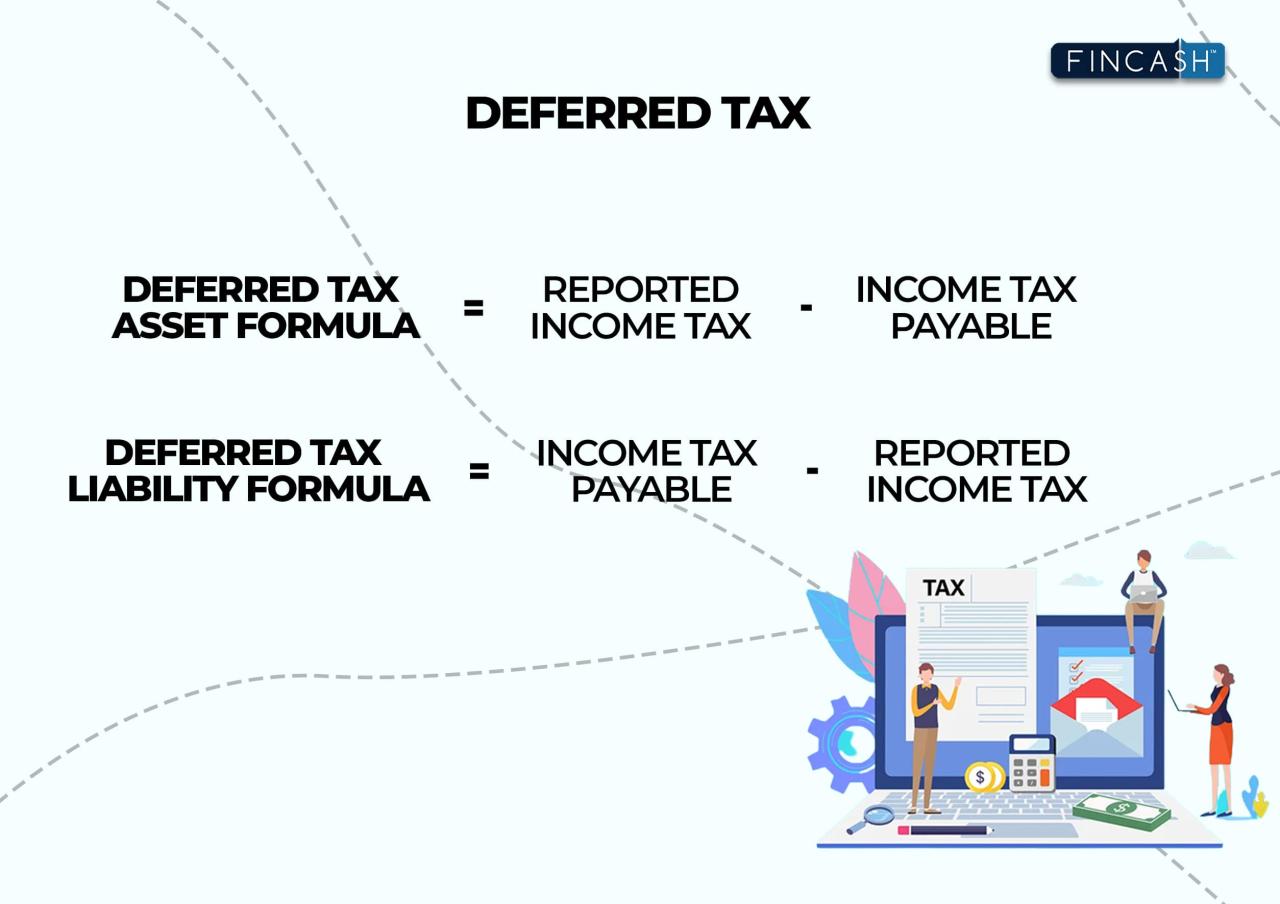

Deferred tax assets and liabilities play a crucial role in accounting, as they reflect timing differences between the recognition of income and expenses for financial reporting purposes compared to tax reporting. Understanding these concepts is essential for accurate financial analysis and tax planning. Deferred tax assets occur when a company has overpaid taxes or has tax-deductible expenses that will benefit future periods, while deferred tax liabilities arise when taxable income is recognized before the corresponding cash taxes are due. This distinction is vital for businesses to manage their tax strategies effectively.

Deferred tax assets and liabilities represent different outcomes of the same underlying timing differences between accounting income and taxable income. The key difference lies in the future tax effects of these differences. Deferred tax assets indicate potential tax savings in the future, while deferred tax liabilities signal an obligation to pay higher taxes down the line.

Differences Between Deferred Tax Assets and Deferred Tax Liabilities

The following points highlight the distinctions between deferred tax assets and deferred tax liabilities, illustrating their unique roles in financial accounting:

- Definition: Deferred tax assets arise when taxable income is less than accounting income, leading to future tax benefits. Conversely, deferred tax liabilities occur when taxable income exceeds accounting income, resulting in future tax obligations.

- Impact on Financial Statements: Deferred tax assets increase total assets on the balance sheet, while deferred tax liabilities increase total liabilities.

- Recognition Criteria: Deferred tax assets must be more likely than not to be realized in future periods, while deferred tax liabilities are recognized as a certainty based on current tax law.

- Tax Treatment: The realization of deferred tax assets can lead to reduced future tax payments, while deferred tax liabilities indicate that the company will incur higher tax payments in the future.

To provide a clearer understanding of scenarios leading to the creation of each type, the following table Artikels specific situations along with their corresponding accounting treatments:

| Scenario | Type | Accounting Treatment |

|---|---|---|

| Carrying forward unused tax credits | Deferred Tax Asset | Recognized as an asset on the balance sheet; reduces future tax expenses. |

| Warranties and estimated liabilities | Deferred Tax Asset | Recognized as an asset; future tax benefit when warranties are claimed. |

| Accelerated depreciation for tax purposes | Deferred Tax Liability | Recognized as a liability; leads to future tax payments. |

| Unearned revenue recognized for tax but not for accounting | Deferred Tax Liability | Recognized as a liability; future taxable income when revenue is recognized. |

Examples of common transactions that can lead to deferred tax assets include carrying losses forward to offset taxable income in future years and recognizing allowances for doubtful accounts in financial statements, which are not immediately deductible for tax purposes. On the other hand, deferred tax liabilities can arise from the use of different methods for depreciation or amortization for tax reporting versus financial reporting, as well as from investments in subsidiaries where income is not recognized for tax until dividends are paid.

Understanding the timing differences between accounting and tax income is crucial for effective tax planning and financial reporting.

Impacts of Deferred Tax on Financial Performance

Deferred tax plays a significant role in shaping a company’s financial performance, influencing both reported earnings and tax obligations. It arises from the differences between the accounting treatment of certain items and their tax treatment, leading to the recognition of deferred tax assets and liabilities. Understanding these impacts is crucial for stakeholders, including investors, management, and analysts, as they assess a company’s profitability and future cash flows.

Deferred tax can considerably affect a company’s reported earnings. When a company recognizes deferred tax assets, it reduces its taxable income, thereby increasing reported profits in the short term. However, this can create a misleading picture of a company’s performance, as these assets may not materialize into actual cash flows if the company fails to generate sufficient taxable income in the future. Conversely, the recognition of deferred tax liabilities indicates that a company may face higher tax obligations in the future, which could erode earnings if not managed properly. The timing of these tax effects is crucial; companies may appear more profitable now but could face challenges later as taxes come due.

Factors Influencing the Recognition of Deferred Tax Assets

Several factors can influence the recognition of deferred tax assets, impacting a company’s financial statements. It’s essential to consider these factors to understand how they affect the overall financial health of the business.

– Profitability Forecasts: Companies must assess their future profitability to determine if they are likely to realize deferred tax assets. If future profits are uncertain, it may limit the recognition of these assets on the balance sheet.

– Tax Law Changes: Legislative changes can alter tax rates or rules, impacting the value of deferred tax assets. Companies must stay informed on tax reforms and adjust their strategies accordingly.

– Historical Profitability: A company’s past earnings can provide insights into its ability to generate future taxable income, influencing the decision to recognize deferred tax assets.

– Valuation Allowances: Companies may need to establish a valuation allowance against deferred tax assets if they believe there is a significant risk that some or all of these assets will not be realized.

Deferred tax has implications for cash flow management within businesses. While deferred tax assets can suggest future tax savings, they do not provide immediate cash flow benefits. Managing cash flow effectively requires a firm understanding of when these tax assets and liabilities will impact actual cash payments. Companies may find themselves in a liquidity crunch if deferred tax liabilities come due while they are also managing operational cash flows.

As an example, consider a company that has significant investments in research and development, leading to large deferred tax assets. If this company does not generate enough taxable income in the subsequent years, it may struggle to utilize these assets, leading to cash flow pressures. Thus, strategic planning around deferred tax not only aids in financial reporting but is also essential for robust cash flow management.

Regulatory Framework Surrounding Deferred Tax

Deferred tax is a crucial aspect of accounting that involves timing differences between the recognition of income and expenses in financial statements and their recognition for tax purposes. The regulatory framework governing deferred tax is primarily shaped by accounting standards like the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Understanding these standards is essential for entities to ensure accurate financial reporting and compliance with tax obligations.

The accounting treatment of deferred tax is specified under IFRS in IAS 12, which Artikels how to account for income taxes, including current and deferred tax. Under IAS 12, deferred tax assets and liabilities are recognized based on the expected future tax consequences of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and their tax bases. This means that when an asset or liability is recorded in the financial statements at a different value than its tax basis, a deferred tax is recognized. Key considerations include the recognition of deferred tax assets only to the extent that it is probable that taxable profit will be available against which the deductible temporary differences can be utilized.

In contrast, the U.S. GAAP, governed by the Financial Accounting Standards Board (FASB), has similar provisions under ASC 740. However, GAAP’s requirements can differ in specific applications of deferred tax accounting, especially concerning the recognition and measurement of deferred tax assets and liabilities. For example, GAAP emphasizes the concept of a “valuation allowance” when there is uncertainty about whether a deferred tax asset will be realized. This results in a more conservative approach compared to IFRS, which may allow for deferred tax assets to be recognized based on expectations of future profits without a stringent review for valuation allowances.

The treatment of deferred tax can vary significantly across different countries, which may have unique tax laws and accounting regulations. For instance, in some countries, tax systems may allow for more accelerated depreciation methods that affect the timing of deferred tax liabilities. In contrast, countries with less complex tax regulations may see a simpler recognition process for deferred tax. This divergence emphasizes the importance of local regulations and the need for multinational corporations to adapt their accounting practices accordingly.

A critical aspect of adhering to these standards is the potential implications of non-compliance. Failing to comply with deferred tax accounting standards can lead to significant consequences, including financial penalties, restatements of financial statements, and a loss of credibility with investors and stakeholders. It can also affect a company’s effective tax rate and cash flow management strategies. Therefore, organizations must prioritize compliance with the applicable accounting standards to mitigate risks associated with deferred tax misstatements.

“Non-compliance can lead to financial penalties, restatements, and loss of credibility.”

Strategies for Managing Deferred Tax

Effectively managing deferred tax positions is crucial for companies seeking to optimize their overall tax efficiency. By implementing strategic actions, organizations can reduce their future tax liabilities and improve cash flow. Understanding the nuances of deferred tax can lead to better financial planning and decision-making. Companies can adopt various strategies that align with their operational frameworks and financial goals, ultimately enhancing their tax position.

One of the primary considerations in managing deferred tax is the timing of income and expenses, which can significantly influence the amount of taxes owed in future periods. Companies must be proactive in identifying opportunities to adjust their timing regarding the recognition of income and expenses. By doing so, they can create favorable deferred tax positions that facilitate improved financial outcomes.

Common Strategies for Mitigating Deferred Tax Liabilities

There are several strategies companies can employ to mitigate deferred tax liabilities. These strategies not only help in optimizing the deferred tax position but also contribute to enhanced cash management and financial reporting.

- Utilizing Tax Losses: Companies can carry forward tax losses to offset future taxable income, effectively reducing deferred tax liabilities. For instance, if a company incurs a loss in the current year, it can apply this loss against profits in subsequent years, lowering the taxable base.

- Accelerating Deductions: Businesses can expedite the recognition of certain expenses, such as capital expenditures, to generate immediate tax deductions. For example, if a company invests in new equipment, it can opt for accelerated depreciation methods, leading to significant deductions in the earlier years of the asset’s life.

- Deferring Income Recognition: Companies can strategically postpone the recognition of income to a future period, especially if they anticipate being in a lower tax bracket. For instance, a software company may choose to recognize revenue from long-term contracts progressively, deferring some income to future tax years.

- Tax Credits and Incentives: Leveraging available tax credits and incentives can reduce taxable income. For example, businesses investing in renewable energy often qualify for substantial tax credits that can offset their overall tax burdens, enhancing cash flow.

- Restructuring Operations: Companies should consider restructuring operations in ways that lower their effective tax rate. This may include relocating operations to jurisdictions with favorable tax regimes, which can create deferred tax assets through lower current tax obligations.

Implementing these strategies can lead to significant improvements in tax efficiency. For instance, a multinational corporation leveraging tax credits for research and development can lower its deferred tax liabilities while simultaneously investing in innovation. Such proactive management of deferred tax not only mitigates liabilities but can also improve investor perceptions, as companies that demonstrate effective tax planning are often viewed as more financially sound and forward-thinking.

In conclusion, managing deferred tax strategically offers substantial financial advantages. By utilizing tax losses, accelerating deductions, deferring income, taking advantage of tax credits, and restructuring operations, companies can optimize their deferred tax positions, enhance cash flows, and foster a more robust financial future.

Future Trends in Deferred Tax Accounting

The realm of deferred tax accounting is continuously evolving, influenced by changes in legislation, advancements in technology, and shifting business practices. As we look ahead, several trends are emerging that promise to reshape how businesses manage their deferred tax positions. It is essential for accounting professionals and organizations to stay ahead of these trends to optimize tax strategies and ensure compliance.

Emerging Trends in Deferred Tax Accounting Practices

One significant trend is the increased focus on transparency and disclosure surrounding deferred tax assets and liabilities. Companies are expected to provide more detailed information in their financial statements about the nature of these entities, leading to enhanced scrutiny from investors and regulators. In light of this, organizations are adopting clearer methodologies and more comprehensive tax reporting frameworks.

Moreover, the push towards sustainability and environmental, social, and governance (ESG) criteria is influencing tax practices. Companies are now considering the tax implications of their sustainability efforts, which may include tax incentives for green investments or penalties for carbon emissions. This shift necessitates a reevaluation of how deferred taxes are calculated and reported.

The integration of technology and automation in managing deferred tax is another notable trend. Companies are increasingly leveraging advanced software solutions and data analytics to streamline tax calculations, ensuring accuracy and efficiency. Automation reduces the manual workload associated with tax compliance and allows for real-time data analysis. This transformation empowers organizations to make informed decisions based on up-to-date information.

Impact of Technology and Automation on Deferred Tax Management

The advent of artificial intelligence (AI) and machine learning (ML) has begun to revolutionize tax management processes. Automated systems can analyze vast amounts of data to identify trends and anomalies, providing insights that were previously challenging to obtain. These technologies enhance predictive capabilities, allowing businesses to anticipate tax liabilities and adjust their strategies accordingly.

Furthermore, automation systems can facilitate the rapid calculation of deferred tax positions amid changing regulations or business circumstances. This adaptability is crucial in an environment where tax legislation may shift frequently, impacting financial planning and cash flow management.

Predictions on Tax Legislation Changes Affecting Deferred Tax Calculations

As tax laws continue to evolve, it is expected that more jurisdictions will adopt measures to encourage investment and innovation, potentially resulting in changes to deferred tax calculations. For example, countries may implement tax reforms aimed at reducing corporate tax rates while increasing incentives for research and development (R&D). Such reforms could lead to new deferred tax assets, requiring companies to reassess their positions regularly.

Additionally, the trend towards globalization may prompt governments to establish more stringent international tax regulations, impacting how deferred taxes are calculated for multinational corporations. Companies must remain agile and informed about international tax developments to navigate these complexities effectively.

In conclusion, the landscape of deferred tax accounting is being reshaped by emerging trends focused on transparency, technology, and legislative changes. Organizations that proactively adapt to these shifts will be better positioned to manage their deferred tax obligations and capitalize on opportunities for optimization.

Last Recap

In summary, the exploration of deferred tax reveals its significant role in both accounting practices and corporate finance. As businesses navigate the complexities of tax obligations and financial reporting, effective management of deferred tax can lead to enhanced tax efficiency and informed decision-making. Understanding the underlying principles and future trends surrounding deferred tax is essential for companies aiming to leverage these insights for better financial outcomes.

Top FAQs

What is the difference between deferred tax assets and liabilities?

Deferred tax assets represent taxes that are recoverable in future periods, while deferred tax liabilities are taxes that are owed in future periods due to timing differences.

How can deferred tax impact cash flow?

Deferred tax can affect cash flow management as it represents future tax obligations or benefits that can influence a company’s liquidity and financial planning.

Are there specific accounting standards that govern deferred tax?

Yes, deferred tax is governed by accounting standards such as IFRS and GAAP, which Artikel the treatment and reporting of deferred tax assets and liabilities.

Can deferred tax be managed strategically?

Absolutely, companies can employ various strategies to optimize their deferred tax positions, such as timing of revenue recognition and expense deductions.

What trends are emerging in deferred tax accounting?

Emerging trends include increased automation and technology integration in managing deferred tax processes, as well as potential influences from changing tax legislation.