Sales tax may seem like just another line item on a receipt, but it carries significant weight in the financial landscape for both consumers and businesses. As shopping habits evolve alongside technological advancements, understanding the intricate details of sales tax becomes essential. From its various types and implications on pricing strategies to the differences across jurisdictions, sales tax is a multifaceted topic that deserves attention.

This exploration of sales tax fundamentals will shed light on its definition, types, and the jurisdictions that impose it, while also showcasing how it varies from state to state and even country to country. Businesses must also navigate the challenges of sales tax collection and compliance, making it vital for them to understand exemptions and the potential impact of audits. Join us as we unpack these elements and more, revealing the intricate web that sales tax weaves across the economic fabric.

Sales tax fundamentals are crucial for understanding its impact on consumers and businesses.

Sales tax is a critical aspect of the modern economic landscape that affects both consumers and businesses alike. It is a form of consumption tax imposed by governments on the sale of goods and services. Understanding sales tax fundamentals is essential for anyone operating within or engaging in commerce, as it influences pricing, purchasing decisions, and overall market dynamics. Each jurisdiction—whether a state, county, or country—has its own regulations regarding sales tax, creating a complex environment that can vary widely from one place to another.

Sales tax can be categorized into several key components. Firstly, it is defined as a tax levied on the sales of goods and services, typically calculated as a percentage of the sale price. The two main types of sales tax are general sales tax, which applies to most transactions, and selective sales tax, which targets specific goods such as alcohol, tobacco, and fuel. Jurisdictions responsible for imposing sales tax include state governments in the United States, while countries may have a national VAT (Value Added Tax) system.

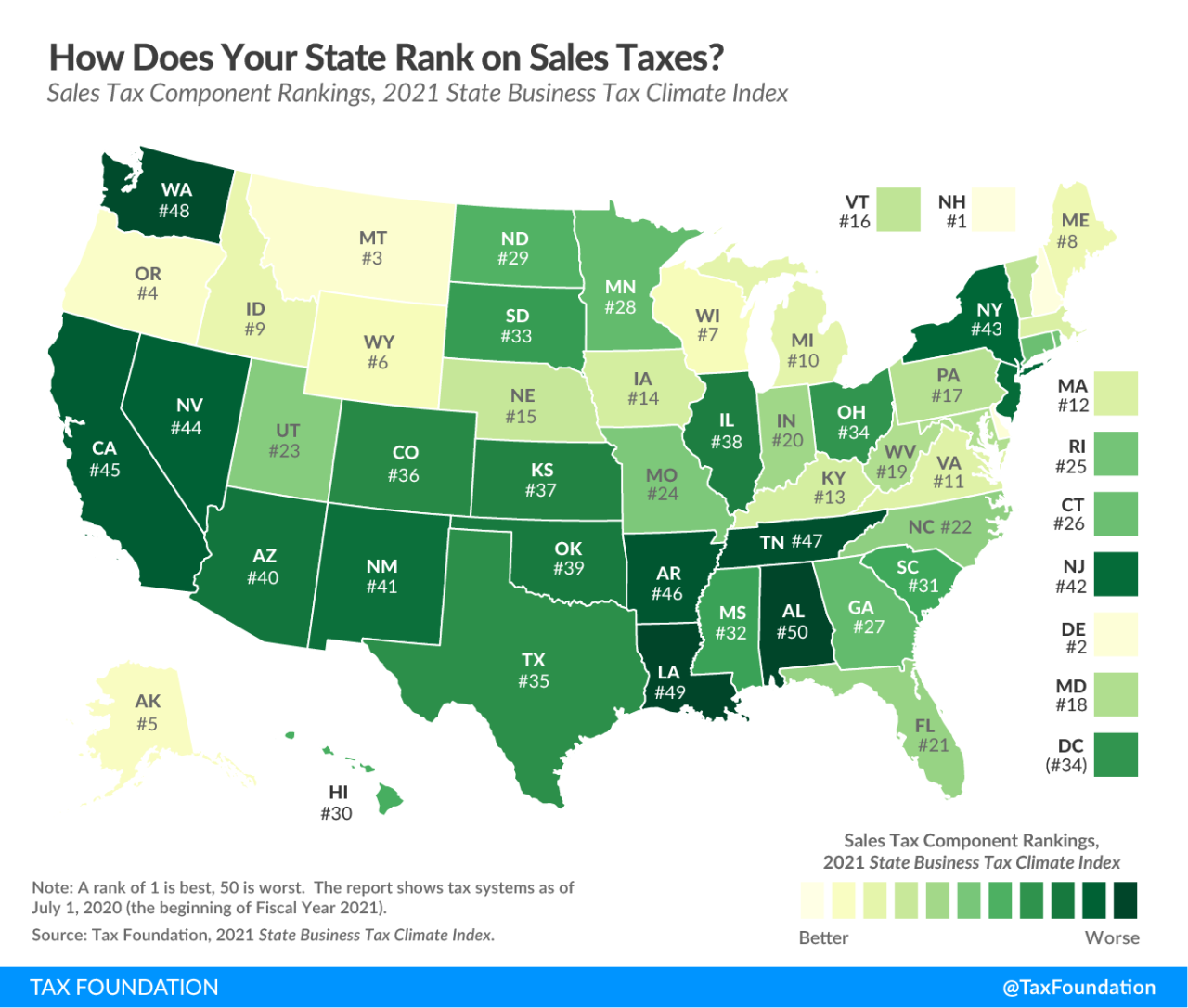

For instance, in the United States, sales tax rates can vary dramatically from one state to another. States like California have a base sales tax rate of 7.25%, while others like Oregon do not charge any sales tax at all. On the international front, countries in Europe typically incorporate a VAT system, which can range from 17% in Germany to 27% in Hungary. Such disparities necessitate a nuanced understanding of local tax regulations for businesses operating in multiple locations.

The implications of sales tax on pricing strategies are significant. Businesses must factor in sales tax when setting prices to maintain competitiveness while ensuring compliance with tax regulations. For example, if a company in New York sells a product for $100 with a 4% state sales tax, the total cost to the consumer becomes $104. Failure to calculate and include sales tax accurately can lead to unexpected costs and potential legal issues, highlighting the importance of integrating sales tax considerations into pricing strategies from the outset.

The mechanisms of sales tax collection involve various processes that businesses must adhere to.

Sales tax collection is an essential aspect of business operations that ensures compliance with state and local tax laws. Understanding the mechanisms involved in collecting and remitting sales tax is crucial for business owners. This process not only helps in maintaining legal compliance but also supports the financial health of the business.

Successfully managing sales tax collection involves several steps that businesses must follow to ensure they are collecting the right amount of tax and remitting it on time. The first step for any business is to determine whether they are required to collect sales tax. This typically depends on the presence of a nexus, which can be established through physical presence, employees, or other economic factors in a particular state. Once nexus is confirmed, businesses must register with the appropriate tax authority, which often requires obtaining a sales tax permit.

After registration, it is imperative for businesses to correctly calculate the sales tax on each transaction. This involves knowing the correct tax rate, which can vary by product or service and location. Many states offer resources or databases to help businesses find the relevant rates. Businesses also need to ensure that their sales systems are set up to automatically calculate and apply the correct tax to applicable sales.

Challenges in Sales Tax Collection

Despite the clarity of these steps, businesses frequently encounter challenges during the sales tax collection process. Common challenges include maintaining up-to-date knowledge of tax rates, ensuring compliance with varying state laws, and managing exempt sales effectively.

Businesses often struggle with compliance due to the frequently changing nature of tax laws. To address this, staying informed through tax workshops or subscribing to tax compliance services can be beneficial. Additionally, businesses should leverage technology by using point-of-sale systems that automatically update tax rates and compliance rules.

Another significant challenge is managing exempt sales, such as those made to non-profit organizations or resellers. Proper documentation must be collected to validate tax-exempt transactions. Implementing a robust tracking system for these exemptions is vital for maintaining compliance.

To facilitate compliance and reduce errors, businesses should maintain specific documentation related to sales tax. This documentation not only serves as proof of compliance but also aids in audits.

- Sales Tax Permits: Proof of registration with state tax authorities.

- Sales Receipts: Detailed records of all sales, including tax collected.

- Exemption Certificates: Documentation for tax-exempt sales to validate exemptions.

- Sales Tax Returns: Copies of filed returns showing collected tax amounts.

- Audit Records: Documentation supporting reported sales and tax collected for audits.

- Communication Records: Correspondence with tax authorities regarding compliance issues.

Maintaining organized records of these documents is essential for ensuring compliance and preparing for potential audits. By systematically following these steps and addressing common challenges, businesses can effectively manage their sales tax obligations while minimizing risks associated with non-compliance.

Sales tax exemptions play a significant role in specific industries and consumer categories.

Sales tax exemptions are crucial provisions that allow certain individuals, organizations, or transactions to be free from sales tax, which is typically charged on the sale of goods and services. These exemptions can significantly impact various industries and consumer categories, fostering growth in sectors such as education, healthcare, and non-profit organizations. Understanding who qualifies for these exemptions and the implications of such policies can help businesses navigate compliance and maximize their financial resources.

Sales tax exemptions vary widely among states and can be based on the type of buyer, the type of product purchased, or the purpose of the purchase. Common qualifiers include non-profit organizations, governmental entities, and educational institutions. For instance, purchases made by a 501(c)(3) non-profit organization are often exempt from sales tax, acknowledging their role in serving the community and providing charitable services. Similarly, public schools and universities may also benefit from exemptions, enabling them to allocate more funds toward educational programs rather than tax liabilities.

Examples of Common Sales Tax Exemptions

Different sectors and consumer categories can take advantage of various sales tax exemptions. Here are some notable examples:

- Non-Profit Organizations: Many states exempt purchases made by qualified non-profits from sales tax. This exemption allows these organizations to allocate funds more directly to their mission-related activities.

- Educational Institutions: Public schools and colleges often enjoy sales tax exemptions on purchases related to education, such as textbooks and supplies.

- Government Entities: Purchases made by local, state, and federal government agencies may also be exempt from sales tax, recognizing their role in public service.

- Food Products and Prescription Medications: Most states exempt grocery food items and prescription drugs from sales tax, promoting public health and accessibility to essential goods.

- Manufacturing Equipment: Many states provide sales tax exemptions for machinery and equipment used in manufacturing, encouraging investment in production capabilities.

The availability of sales tax exemptions can differ significantly from one state to another. For instance, some states might exempt clothing, while others tax it. Below is a comparison chart highlighting the variances in sales tax exemptions across several states:

| State | Clothing Exemption | Food Exemption | Non-Profit Exemption |

|---|---|---|---|

| California | Taxable | Taxable | Exempt |

| New York | Exempt | Exempt | Exempt |

| Texas | Exempt under $100 | Exempt | Exempt |

| Florida | Exempt | Exempt | Exempt |

| Illinois | Exempt | Taxable | Exempt |

Understanding the nuances of sales tax exemptions is essential for stakeholders across various industries to maximize their financial efficiency and ensure compliance.

The relationship between sales tax and e-commerce is evolving rapidly with technological advancements.

The rise of online shopping has significantly transformed the landscape of sales tax collection. As consumers increasingly turn to digital platforms for their purchasing needs, e-commerce has become a crucial frontier in tax compliance. Historically, sales tax was a straightforward affair for brick-and-mortar stores; however, the emergence of online retailers has complicated this landscape. With consumers able to shop across state lines and even internationally, sales tax collection has become more complex. Now, e-commerce businesses must navigate a patchwork of state laws and regulations that vary widely in their requirements and tax rates.

The dynamics shifted notably with landmark legal decisions, particularly the South Dakota v. Wayfair ruling in 2018. This Supreme Court decision overturned the long-standing physical presence standard established in Quill Corp v. North Dakota, allowing states to require online sellers to collect sales tax even if they do not have a physical presence in the state. As a result of this ruling, states have rapidly enacted legislation imposing sales tax obligations on out-of-state sellers, leading to a dramatic increase in compliance requirements for e-commerce businesses. This means that small and medium-sized online retailers, who previously operated without significant tax obligations, now face the complexities of multi-state tax compliance, which can involve substantial resources to manage efficiently.

Adapting to Varying Sales Tax Requirements

To thrive in this evolving landscape, e-commerce companies must proactively adapt to varying sales tax requirements arising from different jurisdictions. Understanding the implications of the Wayfair ruling is crucial, as it emphasizes the need for businesses to implement robust sales tax compliance strategies. Here are some key insights for companies navigating this new terrain:

- Invest in Automation Tools: Leveraging technology, such as sales tax automation software, can streamline the process of calculating, collecting, and remitting sales tax across multiple states. These tools can also keep businesses updated on changes in tax laws and rates.

- Regularly Review Compliance Practices: Companies should conduct periodic audits of their sales tax processes to ensure they are in compliance with current laws. This includes understanding nexus thresholds and filing requirements in various states.

- Educate Staff: Training employees on sales tax obligations and the importance of compliance can help mitigate risks associated with potential audits and penalties.

- Engage with Tax Professionals: Consulting with tax advisors who specialize in e-commerce can provide valuable insights into compliance strategies and help navigate the complexities of multi-state taxation.

As e-commerce continues to grow, businesses must remain agile in adapting to the shifting sales tax landscape. The importance of understanding local tax laws and compliance cannot be overstated, as it directly affects the bottom line and operational efficiency.

Sales tax audits can be daunting for businesses, yet they are a necessary aspect of compliance.

Sales tax audits are an essential process for businesses to ensure they are complying with tax laws. While the prospect of an audit can be intimidating, understanding its purpose and procedures can significantly ease the burden on a business. A sales tax audit involves a thorough examination of a business’s sales records, tax returns, and other relevant financial documents by a tax authority to verify compliance with sales tax regulations. The primary aim is to ensure that the correct amounts of sales tax have been collected, reported, and remitted to the state or local government.

During a sales tax audit, the auditor will typically review transactions and documentation over a specified period, which may vary but often spans several years. The audit process generally begins with the business receiving notification from the tax authority, followed by the collection of required documents such as sales invoices, receipts, and any exemptions claimed. The auditor then analyzes these records, looking for discrepancies or unreported sales. The outcome can lead to assessments of additional taxes owed, penalties, or even refunds if overpayments are identified.

Common triggers for sales tax audits and preparation strategies

Several specific factors are often associated with sales tax audits, and businesses should be aware of these triggers to best prepare themselves. Recognizing these factors can help mitigate the risk of an audit and enhance compliance efforts.

Some common triggers include:

- Unusual patterns in sales data: Significant fluctuations in sales volume, especially spikes that deviate from historical trends, can draw attention from tax auditors.

- Industry-specific red flags: Certain industries, such as e-commerce or consultancy services, are more frequently audited due to historically high non-compliance rates.

- Previous audit issues: If a business has been audited in the past and had discrepancies, it may be more likely to face future audits.

- Failure to file returns: Missing or late sales tax filings are a clear signal to tax authorities that further investigation may be warranted.

To prepare effectively for an audit, businesses can implement several strategies. Firstly, maintaining organized records with clear documentation of all sales transactions is essential. It’s also advisable to conduct internal audits regularly, which can help identify and rectify potential issues before an official audit occurs. Establishing a robust understanding of sales tax laws, including exemptions and regulations specific to the industry, is crucial.

Implementing automated accounting systems can significantly enhance accuracy in sales tax calculations, making compliance easier. Moreover, working closely with tax professionals or consultants who specialize in sales tax can provide businesses with valuable insights, reduce risks, and ensure ongoing compliance with applicable laws.

“An ounce of prevention is worth a pound of cure.” – Benjamin Franklin

The future of sales tax regulations is likely to shift as the economy continues to evolve.

As the economy progresses, particularly in light of rapid technological advancements and shifting consumer behaviors, sales tax regulations are expected to adapt accordingly. The increasing digitization of goods and services, alongside the growth of remote work, presents new challenges and opportunities for tax authorities and businesses alike. Policymakers will need to be responsive to these changes, ensuring that sales tax legislation remains relevant and effective.

The landscape of sales tax legislation is likely to see several key trends in the coming years. First, the rise of e-commerce has prompted states to revisit their sales tax structures. A significant case in point is the 2018 South Dakota v. Wayfair decision, which allowed states to impose sales tax on remote sellers. As more consumers shift to online purchasing, we can expect states to continue refining their sales tax regulations, possibly leading to more uniformity across states. Additionally, the push for more comprehensive tax legislation may see the inclusion of digital goods and services, which have historically been less regulated. This shift can create a more equitable tax environment but may also lead to compliance challenges for businesses.

Impact of Remote Work and Digital Goods on Sales Tax Collection and Enforcement

Remote work has fundamentally altered the way businesses operate, impacting sales tax collection and enforcement in notable ways. With employees working from various locations, defining tax nexus—essentially the connection between a business and a taxing jurisdiction—has become increasingly complicated.

To illustrate, consider a tech company based in California that has employees working remotely in multiple states. This scenario may create multiple sales tax obligations, as the company could be subject to tax collection in each state where its employees reside. As such, companies must adapt their practices to ensure compliance with diverse state laws, which can vary significantly in terms of rates and rules.

Furthermore, as digital goods gain traction, the challenge of tax compliance intensifies. Many jurisdictions are still grappling with how to tax digital products, which may include e-books, online software, and streaming services. For instance, while some states have implemented a sales tax on digital downloads, others remain undecided or have opted for exemptions. This patchwork of laws necessitates that businesses stay informed and agile, adjusting their systems to accommodate potential changes promptly.

Businesses can take proactive steps to ensure they remain compliant with evolving sales tax regulations. This includes investing in technology that enhances tax compliance capabilities and provides real-time updates on changing legislation. Engaging with tax professionals who specialize in sales tax can offer valuable insights and help navigate complex laws. Regular training for staff on compliance practices is also crucial as it fosters a culture of awareness regarding the importance of maintaining accurate tax records.

In summary, staying ahead in the game of sales tax requires vigilance, adaptability, and ongoing education. By preparing for the future landscape of sales tax regulation, businesses can mitigate risks and ensure seamless operations amid evolving economic conditions.

Last Word

In conclusion, the landscape of sales tax is ever-changing, with new trends and legal precedents shaping its future. Understanding sales tax is not only crucial for compliance but also for strategic business planning. As e-commerce continues to grow and the economy evolves, businesses must remain agile, adapting their practices to meet changing regulations. By staying informed and prepared, companies can navigate the complexities of sales tax with confidence, ensuring a smoother journey in their financial dealings.

Query Resolution

What is sales tax?

Sales tax is a consumption tax imposed by governments on the sale of goods and services, usually calculated as a percentage of the sale price.

Who is responsible for collecting sales tax?

Typically, the seller or retailer is responsible for collecting sales tax from the consumer at the point of sale and remitting it to the appropriate tax authority.

Are there items that are exempt from sales tax?

Yes, many jurisdictions offer exemptions for specific items, such as food, clothing, and certain services, as well as for qualifying non-profit organizations.

How does online shopping affect sales tax?

The rise of e-commerce has complicated sales tax collection, with businesses now required to comply with varying tax laws in different states due to legal rulings like South Dakota v. Wayfair.

What are the common challenges businesses face with sales tax?

Common challenges include understanding varying state laws, keeping accurate records, and correctly calculating the sales tax due, especially during audits.