Stamp duty is a critical component of property transactions that often catches buyers off guard. This tax, levied on legal documents related to property purchases, serves not only as a revenue generator for governments but also plays a significant role in shaping the real estate market. Its origins trace back to centuries ago, evolving alongside property laws and economic conditions, making it a fascinating subject to explore.

In various regions, stamp duty manifests differently, with unique rates and exemptions that can significantly affect both buyers and sellers. Grasping the fundamentals of stamp duty, including how it is calculated and the different types available, can empower individuals to navigate the property market more effectively and make informed financial decisions.

Understanding the Basics of Stamp Duty

Stamp duty is a tax imposed by the government on certain legal documents, typically in the context of property transactions. This tax is a critical component in real estate deals, as it validates the transfer of ownership through the payment of a fee calculated based on the property’s purchase price or its market value. The primary purpose of stamp duty is to generate revenue for local and national governments, helping to fund public services and infrastructure.

Historically, stamp duty can be traced back to the 17th century in England, where it was first introduced as a means to raise funds for government projects. Over time, the concept spread to various countries, each adopting their own versions based on local needs and economic conditions. The structure of stamp duty has evolved considerably; initially a fixed fee, it has transformed into a tiered system where rates can vary depending on the value of the property. This evolution reflects changing economic realities and attempts to make home ownership more accessible to diverse populations.

In different regions around the world, stamp duty manifests in various forms, with distinct implications for buyers and sellers. For instance, in the United Kingdom, there is a progressive system known as Stamp Duty Land Tax (SDLT), which increases rates with higher property values. In Australia, stamp duty varies by state, with some regions offering exemptions or concessions for first-time buyers to stimulate the housing market. The implications of these varied structures can significantly affect the total cost of purchasing a property.

Here are some prominent types of stamp duty found in various regions:

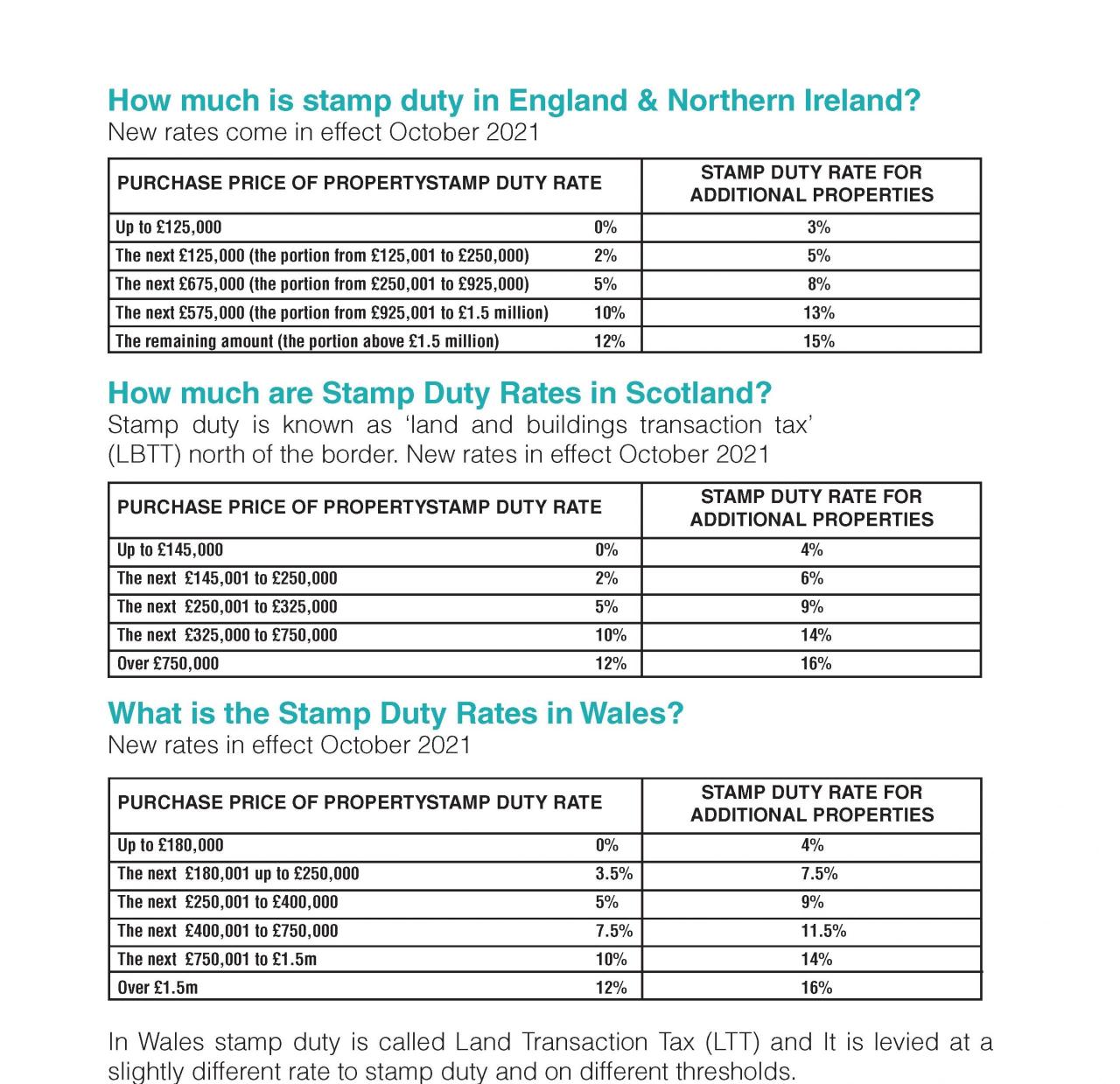

- Stamp Duty Land Tax (SDLT): Applicable in England and Northern Ireland, this tax is charged on property purchases and is tiered based on the purchase price.

- Land Transfer Tax: In Canada, several provinces implement this tax on property transfers, and the rates can differ significantly depending on the province.

- Stamp Duty (Hong Kong): A critical component of property transactions, this tax can include an additional buyer’s stamp duty aimed at non-residents or investors.

- Transfer Duty (South Africa): This tax applies to all property transactions, with rates determined by the value of the property.

Understanding these various forms of stamp duty is essential for anyone involved in property transactions, as they directly affect the financial aspects of buying or selling real estate.

The Calculation of Stamp Duty

Calculating stamp duty is a crucial step when buying property, as it directly impacts the overall cost of the purchase. Understanding how this tax is calculated can save buyers from unexpected financial strain and help them budget more effectively. This guide will break down the various methods used to calculate stamp duty based on different property values and highlight the variations that can arise depending on location and property type.

The calculation of stamp duty typically involves applying a percentage rate to the property’s value. Rates can differ significantly depending on the region and the type of property being purchased, such as residential versus commercial. Below are the key steps and methods used in calculating stamp duty for different property values.

Methods of Calculating Stamp Duty

To accurately determine stamp duty, one needs to consider the value of the property, the applicable rate, and any potential exemptions or discounts. Here’s how to approach the calculation:

1. Identify the Property Value: The first step is determining the purchase price or market value of the property. This value serves as the basis for calculating the stamp duty.

2. Refer to the Stamp Duty Rate Table: Stamp duty rates are usually tiered, meaning different portions of the property’s value are taxed at different rates. Tax authorities publish these rates, which can vary by state or region.

3. Calculate the Stamp Duty: Using the property value and the corresponding rates, calculate the total stamp duty owed. The formula is as follows:

Stamp Duty = (Value within Band 1 x Rate Band 1) + (Value within Band 2 x Rate Band 2) + …

4. Consider Discounts or Exemptions: Certain buyers, such as first-time homebuyers, may qualify for reduced rates or exemptions. Always check local regulations for applicable discounts.

Here’s a simplified example for clarity:

– Property Value: $500,000

– Applicable Rates:

– 0% for the first $300,000

– 2% for the next $200,000

The calculation would be as follows:

– For the first $300,000: $300,000 x 0% = $0

– For the next $200,000: $200,000 x 2% = $4,000

– Total Stamp Duty: $0 + $4,000 = $4,000

Variations in Stamp Duty Rates

Stamp duty rates can greatly vary based on the property’s location and type. Here are some factors that influence these variations:

– State or Region: Each state has its own stamp duty rates. For example, in New South Wales, the rates differ from those in Victoria.

– Property Type: Residential properties often have different rates compared to commercial or investment properties. Some states offer reduced rates for first-time homebuyers, while others impose higher rates for property investors.

– Value Bands: Higher value properties may attract a higher percentage rate, with some regions employing progressive rates where the tax rate increases as the property value rises.

In summary, understanding the calculation of stamp duty is essential for prospective buyers. By considering the property value, applicable rates, and potential discounts, buyers can better prepare for the financial commitments associated with property acquisition. Always refer to local guidelines to ensure compliance and accuracy in calculations.

Stamp Duty Exemptions and Reliefs

Stamp duty can often be a significant financial burden when purchasing property, but various exemptions and reliefs can ease this load for specific buyer categories. Understanding these provisions can help buyers make informed decisions and potentially save a substantial amount during their property transactions.

There are several common exemptions and reliefs available that cater to different circumstances and buyer profiles. These exemptions often reflect government policies aimed at supporting first-time buyers, specific demographic groups, or particular types of transactions. The eligibility criteria can vary significantly from one region to another, which underscores the importance of being aware of local legislation.

Categories Eligible for Exemptions and Reliefs

Certain buyer categories may qualify for stamp duty exemptions or reliefs, minimizing their financial obligations during property purchase. The following categories typically benefit from such provisions:

- First-Time Buyers: Many regions offer stamp duty relief for first-time homebuyers, often up to a certain property value. For instance, in the UK, first-time buyers may not pay stamp duty on properties valued up to £300,000.

- New Build Properties: Some areas provide full or partial exemptions for buyers of newly constructed homes to encourage development and homeownership.

- Shared Ownership Schemes: Buyers participating in shared ownership schemes may not pay stamp duty on the initial share they purchase, providing an affordable pathway to homeownership.

- Transfer of Property between Family Members: In some jurisdictions, transferring property within family members may be exempt from stamp duty, facilitating easier asset distribution.

These exemptions can significantly reduce or even eliminate stamp duty liabilities, allowing buyers to allocate funds toward other essential expenses such as home improvements or moving costs.

Examples of Circumstances for Exemptions

Several practical scenarios illustrate how exemptions can apply, showing potential buyers how they might benefit from these policies:

- A first-time buyer purchasing a £250,000 property in London qualifies for relief and pays no stamp duty, as their purchase is below the threshold.

- A couple opting for a new build home priced at £400,000 may benefit from a partial exemption, reducing their overall stamp duty payment.

- A family transferring ownership of a property valued at £300,000 between parents and children might not incur any stamp duty, simplifying the process.

These examples highlight the varying structures of stamp duty and how they can be leveraged to enhance financial outcomes for specific buyer categories.

Impact of Government Policies on Exemptions

Government policies play a crucial role in shaping stamp duty exemptions and reliefs, often intended to stimulate the housing market or support particular demographics. Over the years, these policies have evolved in response to changing economic conditions and housing needs.

In regions where housing affordability is a pressing concern, governments may introduce temporary exemptions or adjustments to thresholds. For example, during economic downturns, initiatives like temporary relief for first-time buyers can help invigorate the housing market. Conversely, in areas experiencing rapid price increases, there may be discussions about revising exemption criteria to maintain fairness in the property market.

The specifics of these policies can differ widely between regions, with some locations offering more robust relief measures. Buyers should remain informed about local government initiatives and seek guidance from property professionals to maximize their advantages when navigating stamp duty obligations.

The Role of Stamp Duty in Real Estate Market Trends

Stamp duty, a tax imposed on property transactions, plays a significant role in shaping the dynamics of the real estate market. Changes in stamp duty rates can shift buyer behavior, influencing overall market trends and property values. Understanding these effects is crucial for both buyers and sellers navigating the housing landscape.

Adjustments in stamp duty rates directly impact buyer sentiment and purchasing power. For instance, a decrease in stamp duty can stimulate demand by making property purchases more affordable, thus encouraging more buyers to enter the market. Conversely, an increase in stamp duty may deter potential buyers, leading to a slowdown in sales and potentially decreasing property values as demand wanes. The correlation between stamp duty fluctuations and housing market trends is evident, as these tax changes can create ripples throughout the entire real estate ecosystem.

Historical Changes in Stamp Duty and Their Effects on Property Sales

To illustrate the impact of stamp duty changes on property sales, the following table Artikels significant historical adjustments in stamp duty rates alongside corresponding shifts in property transactions.

| Year | Stamp Duty Rate Change | Effect on Property Sales |

|---|---|---|

| 2010 | Reduced from 5% to 4% | Increase in sales by 15% within one year |

| 2014 | Increased from 4% to 5% | Decrease in sales by 10% over the next two years |

| 2020 | Temporarily reduced to 2% | Spike in first-time buyer activity, 25% increase in sales |

| 2022 | Increased from 2% to 3% | Stabilization of sales, no significant changes reported |

The data highlights how changes in stamp duty can have immediate and lasting effects on property sales, illustrating the sensitivity of the housing market to tax policy decisions. By observing these historical trends, stakeholders can better anticipate market movements and make informed decisions based on prevailing conditions.

Challenges and Controversies Surrounding Stamp Duty

Stamp duty has faced considerable scrutiny since its inception, raising various challenges and controversies regarding its impact on property transactions and broader economic implications. Critics often argue that it serves as a financial burden, particularly for first-time buyers, while proponents maintain that it plays a crucial role in generating government revenue. Exploring these differing perspectives reveals the complex nature of stamp duty and its importance in the property market.

The debates surrounding stamp duty often include various criticisms and justifications regarding its existence. Many argue that stamp duty disproportionately affects lower and middle-income earners, making it challenging for them to enter the property market. Conversely, supporters of the tax highlight its role in funding essential public services and infrastructure projects. They argue that without such a tax, governments might struggle to generate sufficient revenue to support community needs.

Common Criticisms of Stamp Duty

Several arguments illustrate the criticisms surrounding stamp duty. The following points highlight key aspects of these criticisms:

- Increased Financial Burden: Stamp duty can represent a significant upfront cost for homebuyers, which can deter potential buyers from purchasing properties.

- Market Distortions: Critics argue that stamp duty can distort property prices, as sellers may increase their asking price to compensate for the tax burden buyers face.

- Impact on Housing Mobility: High stamp duty rates can discourage homeowners from relocating, as the cost of moving becomes prohibitive.

- Regressive Nature: Some contend that stamp duty disproportionately impacts lower-income earners, who may struggle more than wealthier individuals to pay the tax.

Case Studies of Stamp Duty Reforms

Examining regions that have reformed their stamp duty laws provides insights into the potential outcomes of such changes. For instance, in Australia, several states have undertaken reforms to narrow the impact of stamp duty on first-time homebuyers.

One notable case is New South Wales, which introduced a scheme to exempt first-time buyers from stamp duty on properties up to a certain value. This reform led to a noticeable increase in housing affordability and a boost in new property transactions across the state. Additionally, Western Australia implemented a progressive stamp duty system, where rates decrease for lower-priced properties, thereby enhancing accessibility for lower-income individuals.

These reforms often aim to balance the need for government revenue with the necessity of maintaining an accessible housing market, showing that thoughtful policy changes can lead to improved outcomes.

Fairness of Stamp Duty Relative to Income Levels

The fairness of stamp duty in relation to income levels is a contentious issue. The following points delve into how stamp duty interacts with varying income brackets:

- Disproportionate Impact: Lower-income households often spend a more significant portion of their income on stamp duty relative to higher-income households, raising questions about equity.

- Wealth Accumulation: Individuals with substantial wealth may find the tax less burdensome, leading to disparities in homeownership rates across different income groups.

- Policy Considerations: Adjusting stamp duty rates or implementing exemptions for lower-income earners can lead to a more equitable system that promotes inclusivity in homeownership.

“Stamp duty reform can bridge the gap between economic needs and housing accessibility, creating a fairer property market.”

Future of Stamp Duty in a Changing Economic Landscape

The future of stamp duty is poised for transformation as economies around the globe evolve. With shifts in market demands, demographic changes, and fiscal strategies, legislative bodies are increasingly considering reforms to the traditional stamp duty system. Economic pressures, particularly those arising from housing affordability issues and the need for sustainable revenue generation, are driving these discussions.

Legislation surrounding stamp duty is expected to adapt in response to these economic shifts. Governments may explore progressive taxation models that align with current economic realities, which could include reducing the burden on first-time buyers or implementing tiered rates based on property value. Furthermore, as digital transactions become more prevalent, there could be significant changes to how and when stamp duties are collected, potentially moving towards more streamlined, technology-driven processes.

Anticipated Changes to Stamp Duty Legislation

As economic conditions shift, anticipated changes to stamp duty legislation are likely to focus on enhancing equity and efficiency. Potential amendments might include:

- Implementation of deferred payment options for first-time homebuyers, allowing them to pay stamp duty over time rather than upfront.

- Adjustment of rates based on property value thresholds, ensuring lower-income families are not disproportionately affected.

- Incorporation of green principles by offering reduced rates for energy-efficient properties, fostering environmentally sustainable practices in real estate.

- Exploration of a “stamp duty holiday” during economic downturns to stimulate the housing market.

Each of these changes reflects a growing recognition of the need for responsive and equitable taxation policies that can adapt to the changing economic landscape.

Potential Alternatives to Stamp Duty

Governments are increasingly considering alternatives to stamp duty as part of their fiscal strategies. These alternatives aim to create a fairer tax system while ensuring adequate revenue streams. Some noteworthy options include:

- Land value tax, which taxes the value of the land itself rather than the properties built on it, potentially encouraging better land use.

- Annual property taxes based on a percentage of the property’s market value, providing a steady revenue source and reducing the burden of large upfront fees.

- Transaction-based taxes that replace stamp duty with a smaller fee per transaction, aiming to simplify the process for buyers and sellers alike.

- Increased income tax on capital gains from property sales, which could redistribute wealth more effectively while discouraging speculative buying.

These alternatives not only seek to mitigate the financial impact on homebuyers but also aim to enhance the overall efficiency of property taxation.

Comparative Analysis of Property Taxes in Other Countries

Examining how other countries manage property taxes and alternatives to stamp duty provides valuable insights for potential reforms. Countries like Australia, New Zealand, and Canada have unique approaches that can inform future policy decisions.

| Country | Property Tax System | Alternatives to Stamp Duty |

|---|---|---|

| Australia | Stamp duty varies by state, typically based on property value | Consideration of land tax reform and ongoing discussions about replacing stamp duty with a broad-based land tax |

| New Zealand | No stamp duty; relies on a capital gains tax for property sales | Ongoing debates regarding the introduction of a land value tax |

| Canada | Provincial variations of land transfer taxes | Some provinces considering the implementation of a tax on speculative gains |

Understanding these international frameworks helps frame the discourse around potential reforms to stamp duty, emphasizing the need for an adaptable and progressive approach to property taxation in response to evolving economic conditions.

Practical Steps for Buyers and Sellers Regarding Stamp Duty

When it comes to property transactions, stamp duty can often be a complex element that buyers and sellers need to navigate. Understanding how stamp duty works and preparing for it can alleviate a lot of stress during the buying or selling process. This section Artikels practical steps, checklists, and resources to help both buyers and sellers manage their stamp duty obligations effectively.

Checklist for Buyers Preparing for Stamp Duty Payments

Being a buyer means taking on the responsibility of stamp duty payments, and preparing for this expense can help facilitate a smoother transaction. Below is a checklist that buyers should consider when getting ready to pay stamp duty:

- Research your local stamp duty rates and regulations to understand your obligations.

- Calculate the estimated stamp duty based on the purchase price of the property.

- Inquire about any exemptions or concessions that may apply to your situation, such as first-time buyer benefits.

- Ensure you have sufficient funds set aside for stamp duty in addition to your deposit and other fees.

- Consult with your legal advisor or conveyancer to clarify your stamp duty responsibilities.

- Keep all relevant documentation, including the property sale agreement and tax assessment notices, organized for easy reference.

Advice for Sellers Navigating Stamp Duty Implications

For sellers, understanding the stamp duty implications can significantly impact the sales process and overall financial planning. Here are practical steps for sellers to consider:

- Be aware that while sellers do not pay stamp duty, they should disclose any relevant stamp duty information to potential buyers to promote transparency.

- Consider the timing of your sale, as this may impact the buyer’s willingness or ability to absorb stamp duty costs.

- Prepare and provide documentation that might help the buyer understand their expected stamp duty, including details about previous sales in the area.

- Maintain communication with real estate agents to guide prospective buyers on financing options that include stamp duty payments.

- Evaluate the overall market conditions that might affect buyers’ ability to pay stamp duty, adjusting your strategy accordingly.

Resources and Tools for Understanding Stamp Duty Obligations

Having access to the right resources can simplify the process of understanding and calculating stamp duty obligations. Here are some valuable tools and resources:

- Online stamp duty calculators available on government websites offer quick estimates based on property value.

- Government publications and guides explaining stamp duty regulations, exemptions, and concession eligibility.

- Local council websites often provide specific information on stamp duty rates and any applicable changes.

- Legal or financial advisors can provide personalized advice and help navigate complex stamp duty regulations.

- Real estate agents often have insights into local market practices and can assist in understanding stamp duty-related questions during negotiations.

Closure

In conclusion, understanding stamp duty goes beyond merely knowing the tax rate; it encompasses recognizing its implications on market trends, buyer behavior, and potential exemptions. As we venture into a changing economic landscape, keeping abreast of future developments in stamp duty legislation will be essential for anyone involved in property transactions. Ultimately, being informed about stamp duty can lead to smarter decisions in the real estate market.

Essential FAQs

What is the purpose of stamp duty?

Stamp duty serves as a tax on property transactions, helping to fund public services and infrastructure.

Who is responsible for paying stamp duty?

The buyer typically pays stamp duty, although this can vary based on agreements made during the sale.

Are there exemptions for first-time homebuyers?

Yes, many regions offer stamp duty exemptions or reliefs for first-time homebuyers to promote property ownership.

How often do stamp duty rates change?

Stamp duty rates can change based on government policy, economic conditions, and regional regulations, so it’s important to stay informed.

Can stamp duty be included in a mortgage?

In some cases, buyers can negotiate to include the cost of stamp duty in their mortgage, but this depends on the lender’s policies.